- Blog

- How to Import a Used Car to Algeria

How to Import a Used Car to Algeria

Want to import cars from the EU to Algeria with ease? Find out the key rules, prepare the right documents, and check the taxes step by step for a smooth process.

Importing cars from the EU to Algeria is an excellent way to offer vehicles that customers can’t easily find locally, or to give them a better price than what is available on the Algerian market. For traders, Algeria can be an interesting opportunity.

However, car imports here come with their own set of rules and required documents.

If you learn about these in advance, you’ll save time, prevent mistakes, and then complete the import smoothly from purchase to delivery.

Get to know the Algerian car market

Algeria is one of the largest automotive markets in Africa, but it also changes direction quickly.

According to Focus2Move, the market grew strongly in 2024. That year, 200,840 new vehicles were sold, which was the highest sales volume since 2015.

After that, registrations have lowered in the first half of 2025, falling by 34.4% compared with the same period a year earlier.

These ups and downs show how deeply Algeria’s car market depends on both economic shifts and government decisions. For instance, diesel cars are no longer allowed to be imported, which has made buyers and traders focus on petrol and LPG models instead.

This has also shaped which brands perform best.

Currently, Fiat is in a leading position. Geely came into second place in terms of sales, while Opel ranked third. There’s also a demand for Chery cars.

As you can see, Chinese manufacturers are beginning to emerge in Algeria’s EV sector. The adoption of electric vehicles is still at an early stage, but the availability of imported EVs gives buyers access to this technology.

Import regulations of Algeria

Before you start planning the import, there are some things you should keep in mind about what types of cars you’re allowed to bring into the country according to the new import law.

The two most important conditions for importing a car from abroad to Algeria are:

- No diesel cars: Algeria has banned the import of diesel-powered vehicles.

- Age restriction: Imported vehicles must be less than three years old at the time of import.

Other than these conditions, registered dealerships are allowed to import to Algeria on a commercial scale, while individuals can only import one car for personal use every three years.

With that in mind, you’re ready to look at the documents and procedures needed for the import process.

Documentation for importing a vehicle to Algeria as a business

If you are importing cars into Algeria as a business, you will need to prepare a complete set of documents before shipping.

eCarsTrade tip! Double-check whether documents need to have an official translation into Arabic.

eCarsTrade tip! Double-check whether documents need to have an official translation into Arabic.

According to previous experiences of eCarsTrade dealers, some documents in French are also accepted, like the purchase invoice. However, bear in mind this information is unofficial and should be double-checked with the authorities.

► Vehicle purchase invoice

Vehicle purchase invoice proves your ownership of the car. It shows seller details and the vehicle’s specifications and price, which you’ll need later for calculating taxes.

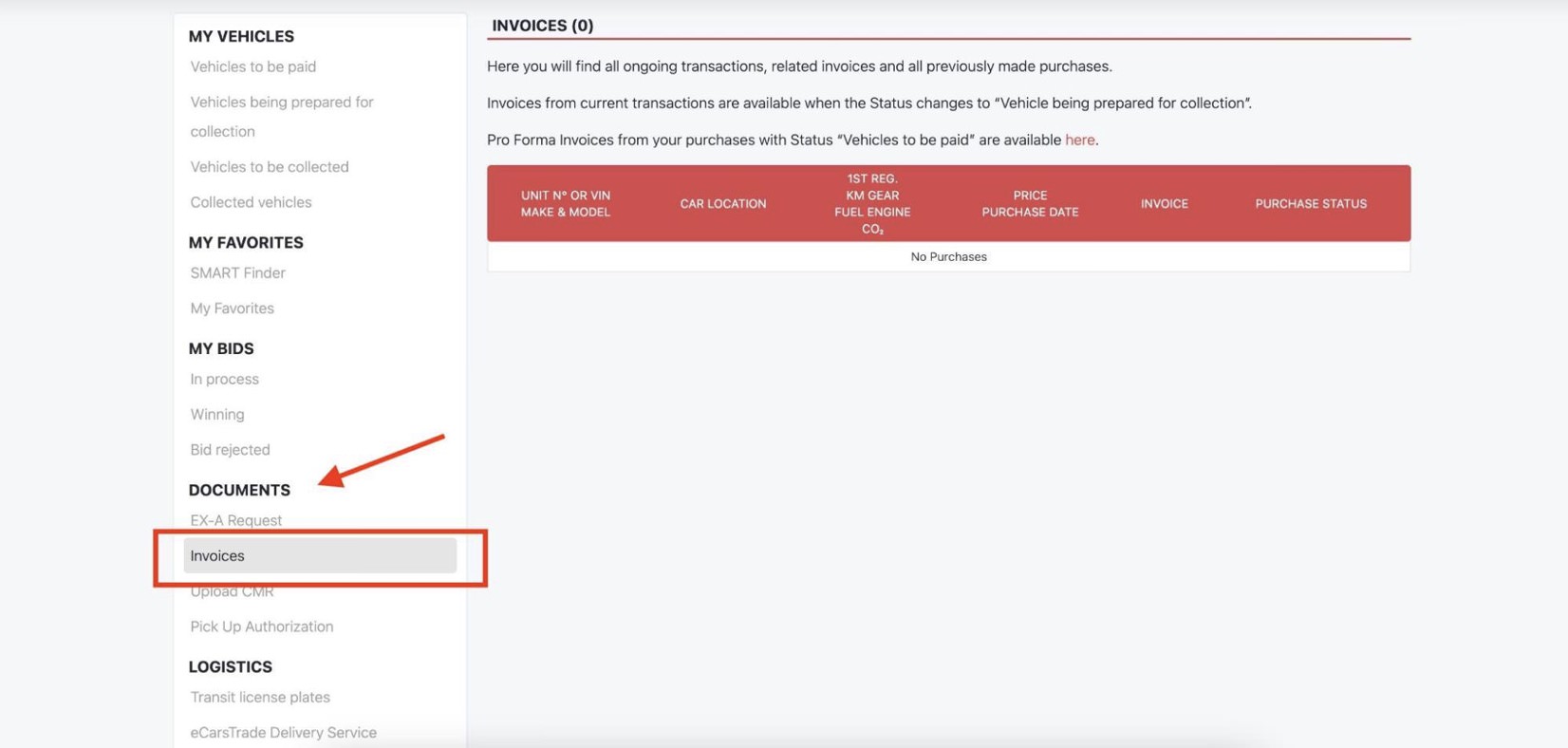

When you purchase your car through eCarsTrade, the vehicle purchase invoice will be available on your Personal Page.

► Buyer’s identity card or passport

You’ll need a copy of the buyer’s ID or passport to confirm the identity of the person responsible for import.

► Original registration papers

Bring the original registration from the country where the car was last registered. This confirms that the vehicle is genuine and shows its ownership history.

Cars sold on eCarsTrade come with original registration documentation, so you won’t have to worry about arranging them yourself.

► Certificat de cession – for French cars

If the car comes from France, which is one of the main sources of used vehicles for Algeria, you’ll also need the Certificat de cession.

The seller and the buyer both sign this official transfer form. It confirms the change of ownership and allows the car to be exported from France.

When buying French vehicles on eCarsTrade, we will provide you with the cession document.

► Technical inspection certificate

To import a car to Algeria, you’ll have to prove that it’s in good condition. You’ll do this with a certificate from a technical inspection that is less than three years old.

If the car doesn’t already have one, you can order this service through eCarsTrade.

For an extra fee (around €300 to €400), we arrange the technical control before export so your vehicle meets Algerian requirements without delays.

► COC

The Certificate of Conformity (COC) is a document that shows that the car follows official safety and environmental standards.

For imports to Algeria, the COC must be less than three years old. If the car doesn’t already come with one, you can buy a copy from COC providers like EUROCOC or COC Europe.

► EX-A export declaration

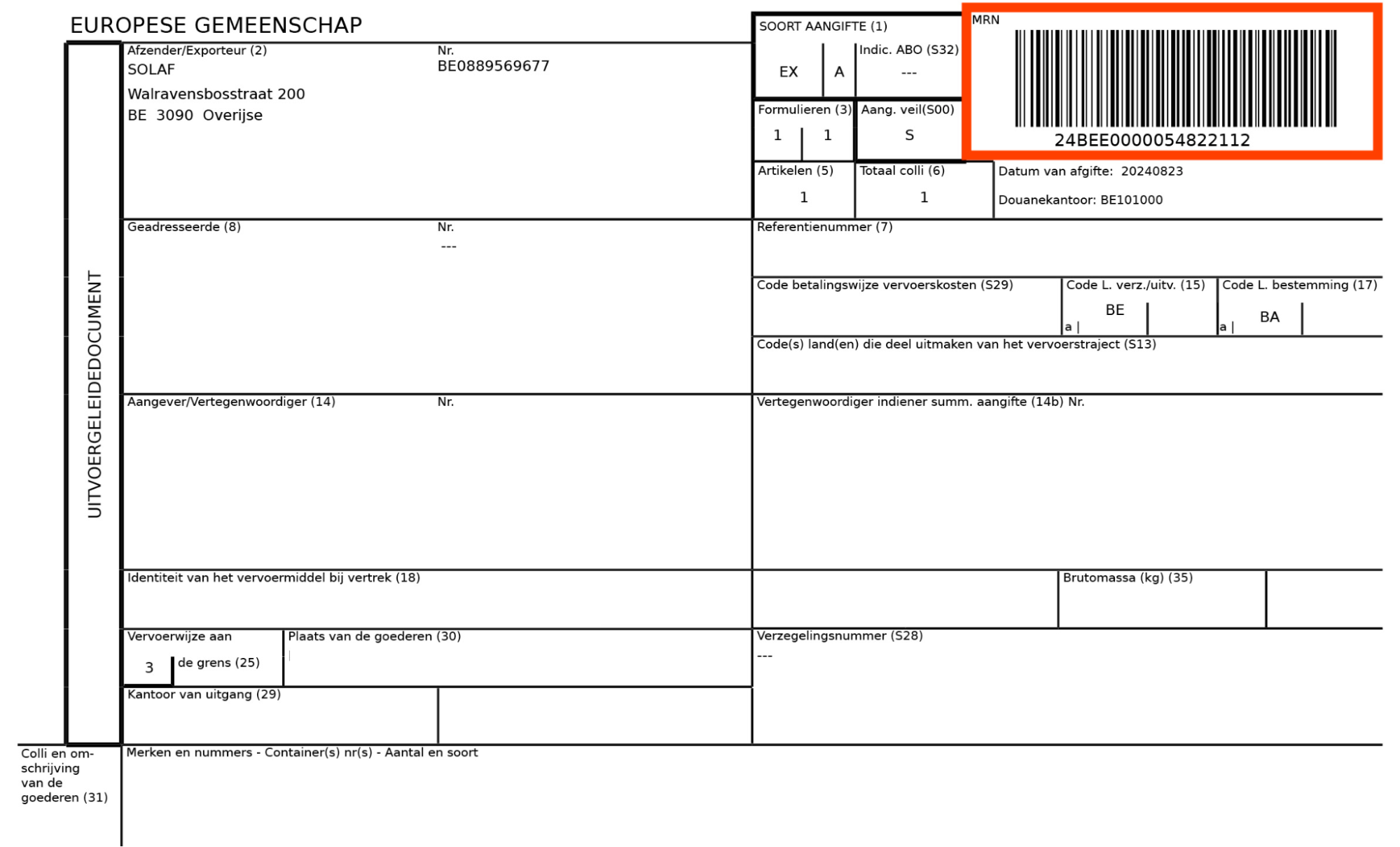

The EX-A is the EU document that proves the car is officially exported. It must be issued before the car leaves Europe.

For eCarsTrade buyers, we can prepare the EX-A and make sure the export is processed correctly. You will need to inform us of the last EU border - this information is mandatory.

eCarsTrade tip! You need the EX-A for clearing customs, but also for getting the VAT refund.

eCarsTrade tip! You need the EX-A for clearing customs, but also for getting the VAT refund.

So, don’t forget to prepare yours on time.

Taxes when exporting a car to Algeria

Now, let’s see what taxes and fees you’ll have to pay as part of the export.

Keep in mind that all payments must go through an Algerian bank, and the bank must officially register your invoice before customs will release the car.

Customs duties

Most imported cars are subject to customs duties of around 30% of the car’s customs value, though the amount can vary.

This makes customs duties one of the largest costs to consider when importing to Algeria.

However, electric vehicles benefit from lower customs duties, with reductions of up to 80% compared to regular cars.

So, if you’re wondering how to calculate customs duties on used cars in Algeria, it’s best to contact Algerian customs directly and find out what rates apply to your case.

VAT

Your next cost to plan is value-added tax (VAT). It’s calculated at the standard rate of 19% and applied to the customs value plus duties.

Solidarity fee

Starting in 2025, Algeria increased the solidarity fee on imported goods to 3%. This fee goes to the National Retirement Fund and applies in addition to other import taxes.

Port charges

Besides taxes and duties, you might also face port charges. These are not government taxes, but fees added by shipping or logistics companies for things like unloading, handling, or storage.

If the car stays at the port longer than planned, the costs can rise, so it’s a good idea to check them in advance with your freight partner.

Step-by-step process - from purchasing a car to importing it to Algeria

Here’s how the process of buying used cars from abroad usually works. Remember to prepare Arabic translations of all the documents you encounter!

1. Choose and buy the car

The first step should be researching your local market. A quick glance at Algerian trends suggests that mainstream models like Fiat are among the most purchased cars.

At the same time, EVs are becoming an interesting option because they benefit from much lower customs duties compared to petrol cars.

Whatever you choose, remember the import rules:

- The car must be less than three years old

- Diesel models are not allowed

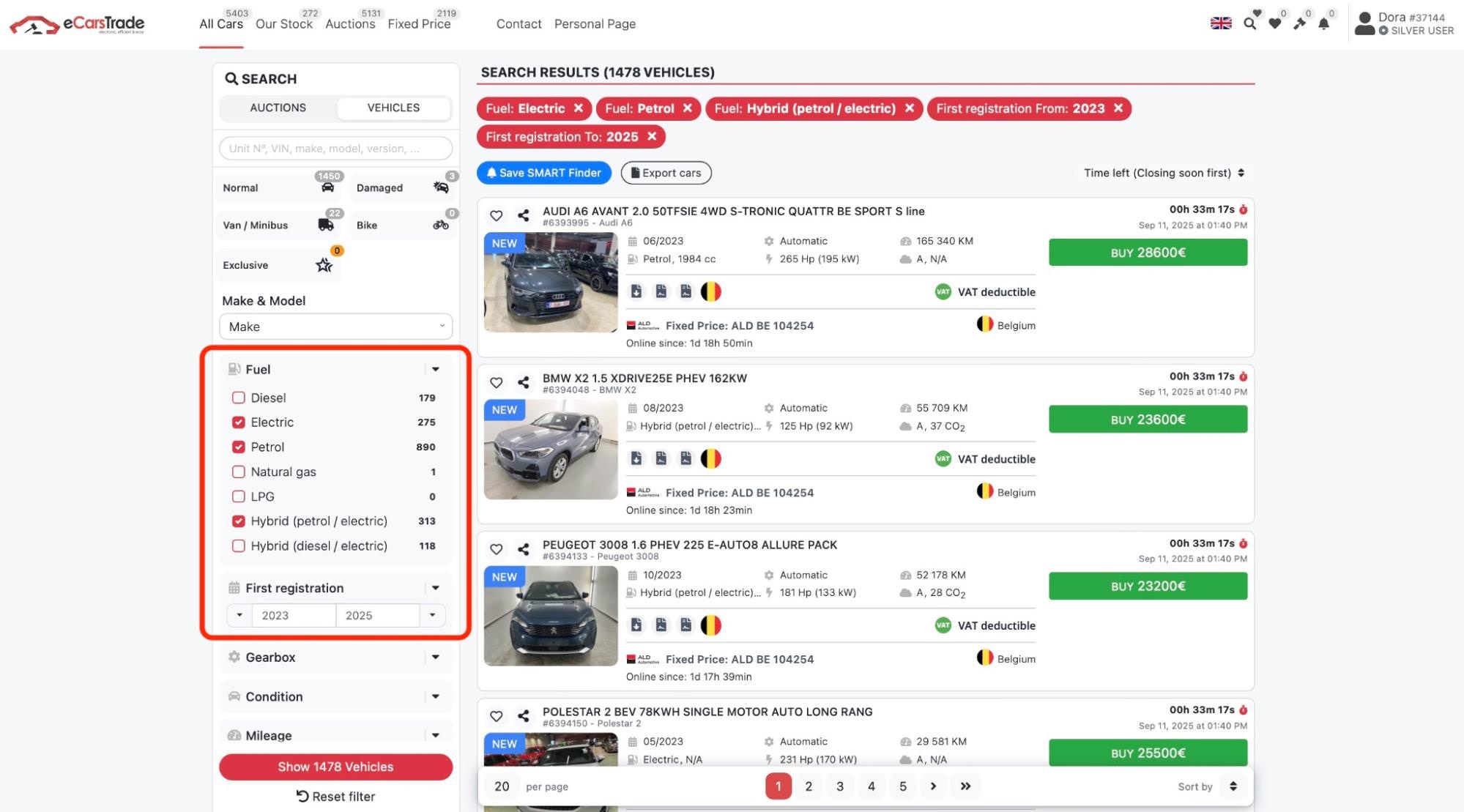

On eCarsTrade, you can easily apply filters for age and fuel type, so you only see cars that meet Algeria’s import conditions.

If you used a third party to send the payment on your behalf, you will need to send a confirmation email to eCarsTrade.

You’ll need to provide a valid passport of the buyer or the company’s owner. Then, we’ll issue the invoice that you’ll later need for customs clearance and registration in Algeria.

2. Go through technical inspection

If the car doesn’t already have a valid technical inspection certificate (less than three years old), you can order one through eCarsTrade. This usually costs about €300–400.

3. Book a ferry / transport

Your next step is arranging the transport for your car. You can ship the car in a container or by RoRo (roll-on/roll-off) service.

Containers usually offer more protection, while RoRo is often faster and cheaper.

4. Prepare export documents

Before shipping, you must sort out export paperwork. At this point, you can prepare the invoice and the EX-A declaration.

You also have to confirm the final EU border crossing or exit port.

eCarsTrade tip! Once the border is entered on the EX-A, you can't change it anymore, so make sure your transport booking is finalized before submitting it.

eCarsTrade tip! Once the border is entered on the EX-A, you can't change it anymore, so make sure your transport booking is finalized before submitting it.

5. Arrange transit plates and pick up the car

You’ll need transit plates to move the car legally before it leaves Europe.

We recommend using transit plates from the seller’s country. In our case, you can use Belgian transit plates and we’ll help you understand the process of obtaining them.

Once you have them, you can pick up the car and get it ready for transport.

6. Check export status on MRN

Once the car is exported, we check the export status via the MRN (Movement Reference Number) to make sure everything is processed properly.

VAT refund

As a non-EU buyer, you’ve paid the VAT deposit when purchasing the car. eCarsTrade has prepared the EX-A export document, which is required to process the refund.

Once the car leaves the EU and the EX-A is officially registered at the border, you can request the VAT refund.

Check the export status through MRN, and after providing proof of export, eCarsTrade will refund the VAT to the same account used for the purchase.

Clear customs and register the car

With the car in Algeria, you’ll need to pay customs clearance, VAT, and the solidarity fee.

Also, you’ll need certain documents to register it: the invoice, registration papers, COC, French Certificat de cession (if it’s a French car), and the technical inspection certificate.

Keep in mind that import laws and requirements can change, so it’s important to check the latest rules before starting the process.

Importing a used car to Algeria - FAQ

► Can I import any type of car to Algeria?

No. Cars must be less than three years old, and diesel cars are not allowed. Petrol, LPG, hybrid, and electric cars can be imported if they meet these conditions.

► What taxes will I pay when importing a car?

The main costs are customs duties (around 30%), VAT (19%), and the solidarity fee (3%). You'll also have to cover port costs for handling or storage. Note that EVs benefit from much lower customs duties.

► Can I get the VAT back after export?

Yes. As a non-EU buyer, you first pay VAT as a deposit. After the car crosses the EU border and the EX-A is registered, you can claim the VAT refund. eCarsTrade refunds it to the same bank account from which the payment for the vehicle was originally made.

► What should I prepare for customs clearance in Algeria?

You’ll need your invoice, registration documents, COC, technical inspection certificate, and the Certificat de cession if the car is French. Double-check if all these documents need to be translated into Arabic.

L'importation de véhicules depuis l'Europe peut être complexe, mais eCarsTrade est là pour simplifier le processus. Découvrez comment :