- Blog

- How to Import a Car to Sweden

How to Import a Car to Sweden

Importing used cars to Sweden? This guide covers documents, taxes, and step-by-step procedures to help you import smoothly.

Importing and reselling used cars from abroad can be a smart business move. You can find better prices, access a wider range of vehicles, and offer models that aren’t always available locally.

But to make sure your importing efforts are profitable, you need to know how the Swedish market works, what documents you’ll need, and how much the process will cost. So, let’s see what you have to know about regulations, fees, and paperwork when importing cars from Sweden.

Documentation for importing a vehicle to Sweden as a business

You’ve now seen the state of the market, and it’s time to start preparing for import. The first step is getting your documents in order.

Vehicle purchase invoice

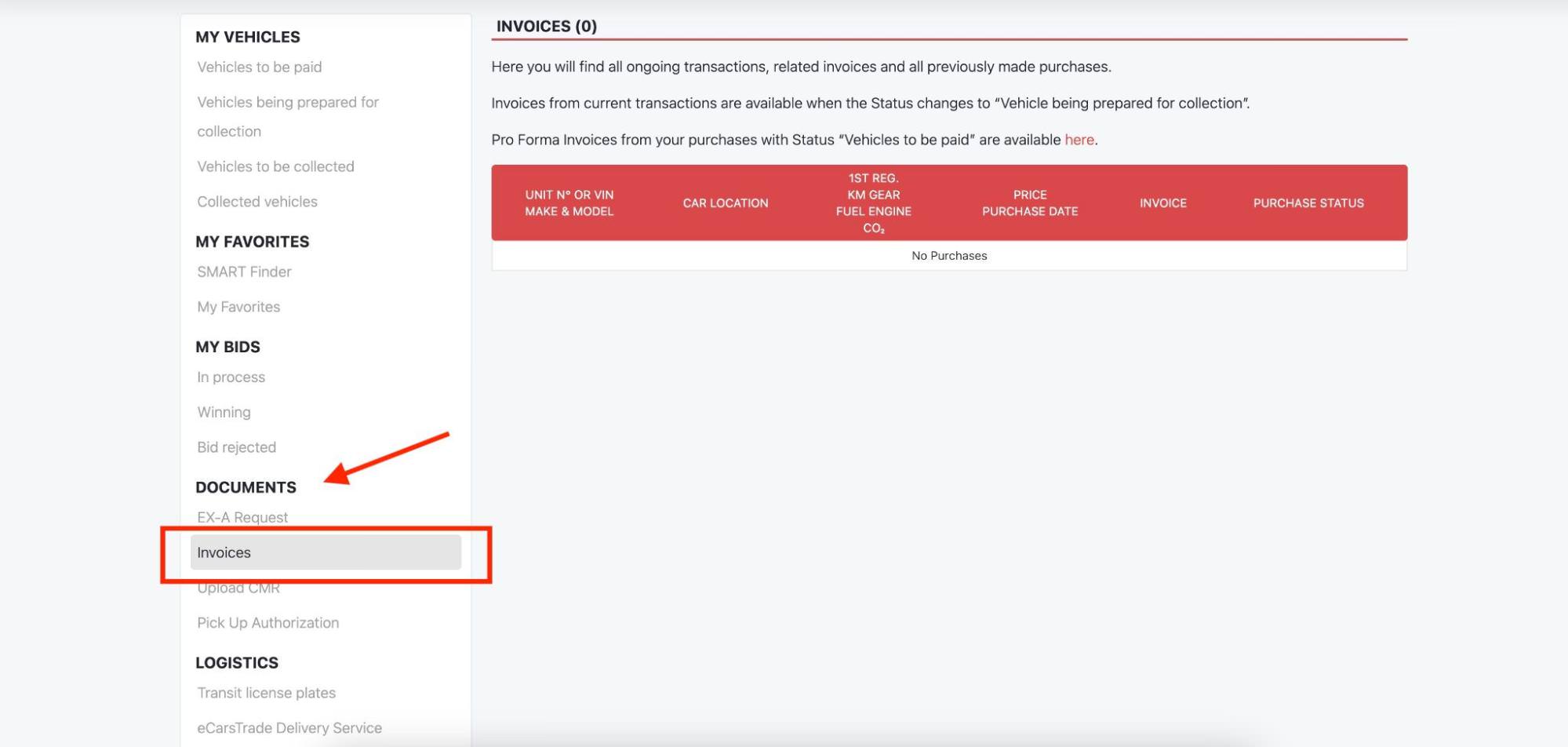

You’ll have to prepare proof of buying and paying for the vehicle, which is your vehicle purchase invoice.

The invoice should state the buyer and seller details, purchase date, vehicle information and price. When buying through eCarsTrade, you can find your invoice in your Personal Page.

The Swedish regulations state that the VIN must be visible on purchase documents, so make sure it’s clearly listed on your invoice.

Original registration papers

You’ll also need the vehicle’s original registration certificate. All listed cars on eCarsTrade come with original registration papers.

Certificate of Conformity (CoC)

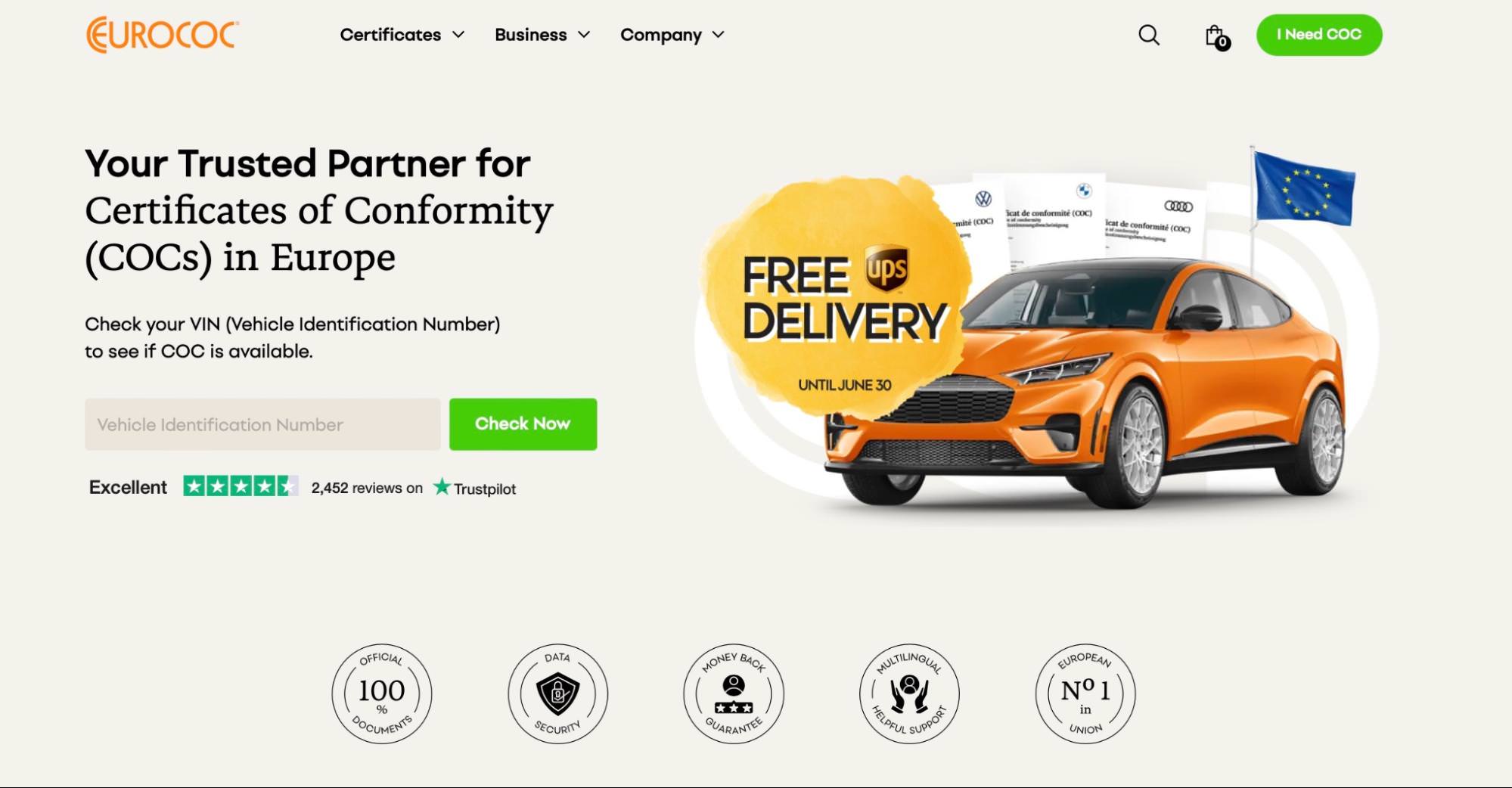

The next document to obtain is the car’s certificate of conformity, which proves the vehicle meets EU technical and environmental standards. It’s required for registration in Sweden.

Used cars are frequently sold without original COC certificates, so keep in mind that you’ll likely have to buy one before importing.

Authorized providers like EuroCOC or COC Europe can help you obtain the certificate based on the car’s VIN.

Proof of identity

If you’re importing as a registered car dealership, you’ll have to provide proof of business registration (a company certificate or VAT ID).

Taxes when importing a car to Sweden

Here’s an overview of taxes and fees you’ll need to pay when importing cars to Sweden.

VAT

The rules for value added tax (VAT) are fairly simple. If you’re buying a new car (less than 6 months old or driven less than 6,000 km) or a car sold VAT-excluded, you have to pay the standard Swedish VAT rate of 25%, even if the car comes from another EU country.

But when it comes to used cars, VAT usually doesn’t apply if both you and the seller are VAT-registered in the EU and the invoice is issued without VAT.

Customs duties

Keep in mind that different rules apply when importing a vehicle from outside the EU. In that case, you’ll typically have to pay both customs duties and Swedish VAT on the full value of the car.

Origin verification application fee

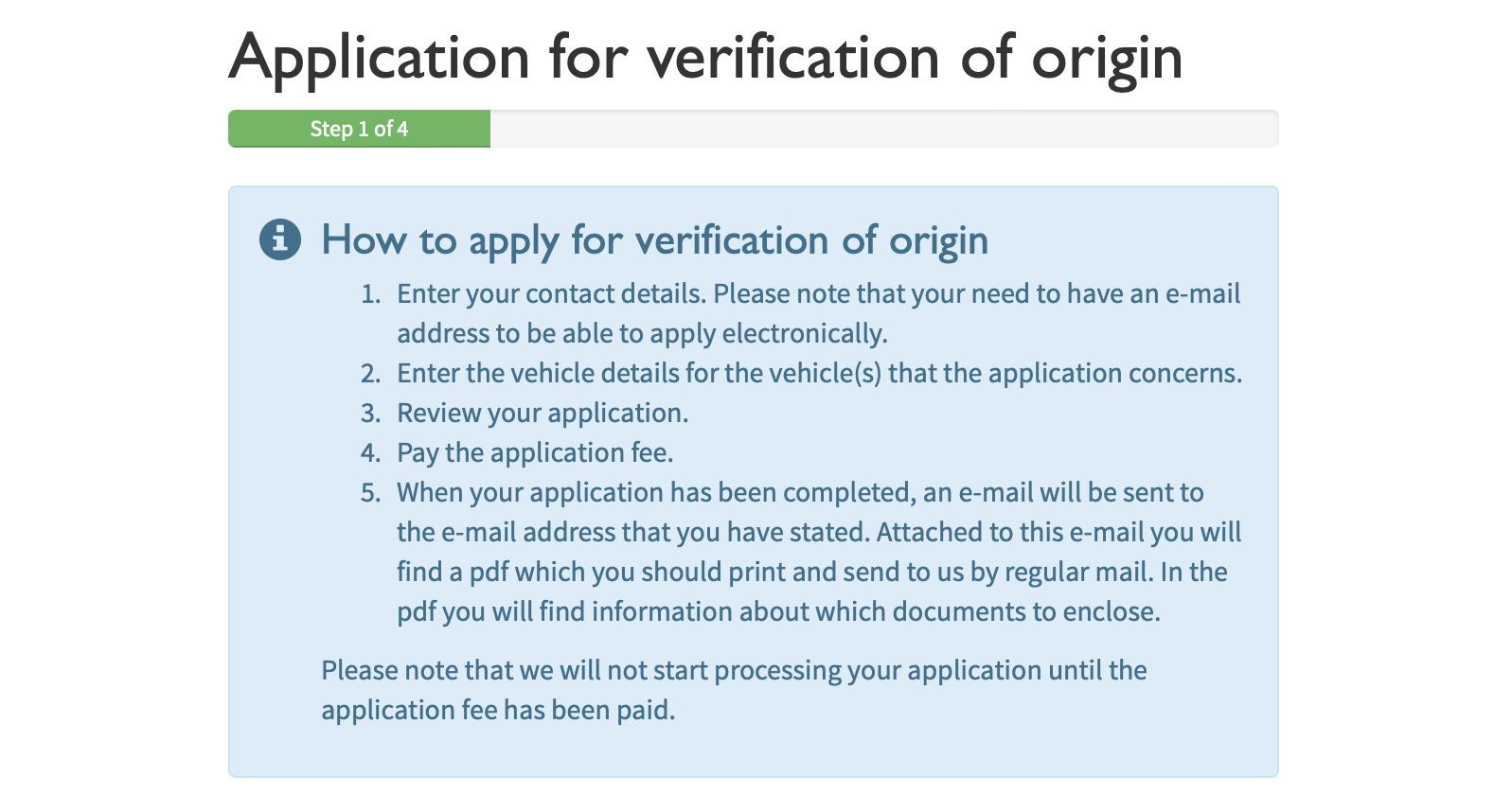

Before the owner can register an imported car in Sweden, they must apply for origin verification with the Swedish Transport Agency. As of 2025, the application fee is 1,240 SEK.

Other fees that the owner will have to pay include:

- Registration fee: approx. 600 SEK

- Inspection fees: approx. 1,500–2,500 SEK

- Vehicle tax: varies by emissions and fuel type (billed after registration)

Step-by-step process - from purchasing a car to importing it to Sweden

We’ve seen individual bits of the import process, so let’s put it all together and go through each step, starting with buying the car.

1. Research and buy the car

Ideally, you’ll start by researching your local market to understand what types of cars are in demand. Look at recent sales trends, preferred fuel types, and which models sell quickly.

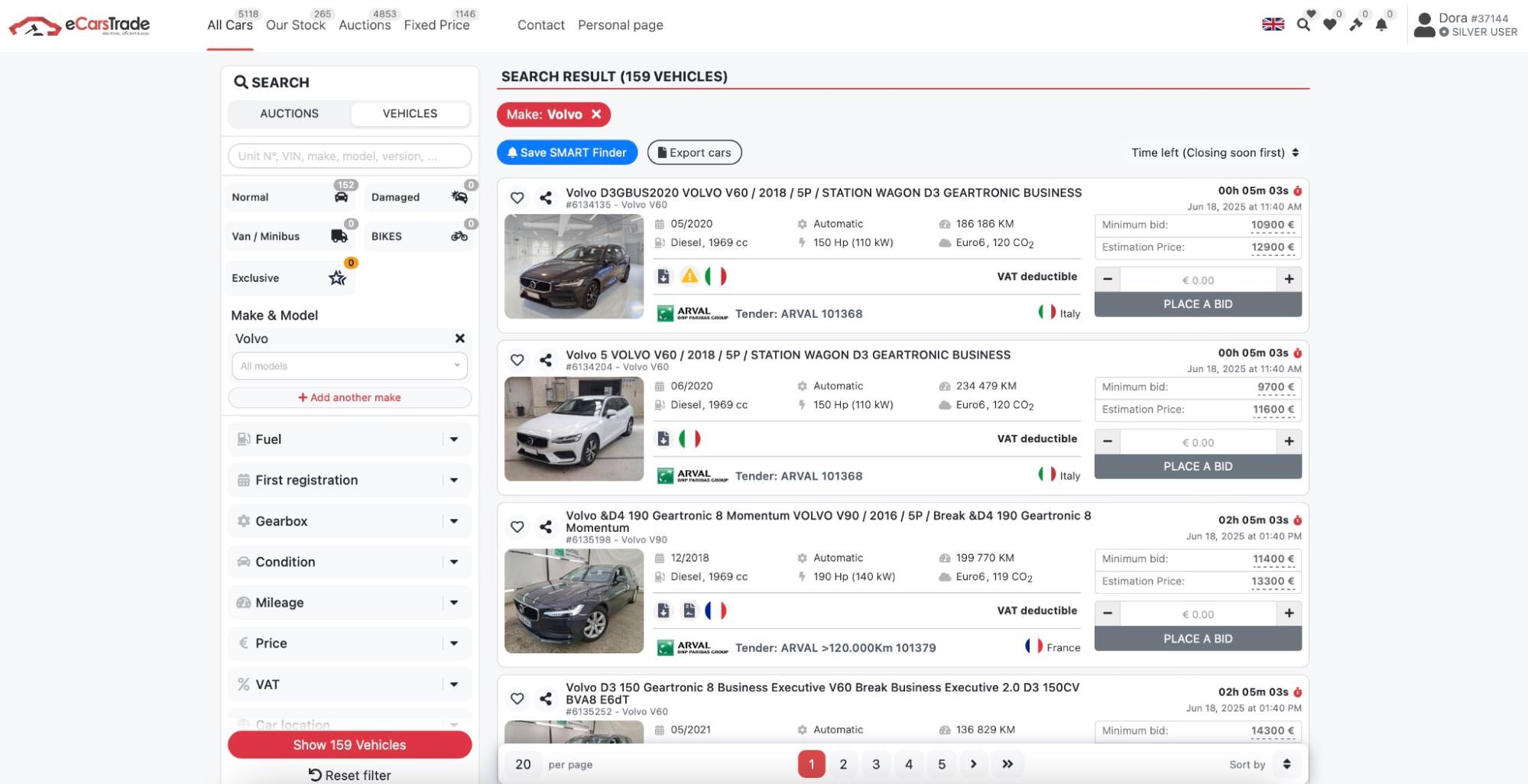

So, let’s say you’ve settled on Volvo, as they’re the most popular brand in Sweden.

You can go to eCarsTrade, filter auctions by make and model, select Volvo, and you’ll get an overview of all Volvo models currently on auctions.

After you’ve placed a bid and won a car, you can pay within the platform. You’ll then receive the vehicle purchase invoice, the first document you’ll need for import.

2. Arrange transportation to Sweden

If you’re buying cars from abroad, you’ll need to arrange transportation to your dealership in Sweden.

Most dealers buying from eCarsTrade decide to transport cars via our eCarsTrade delivery service. The service handles the entire transport for you, from paperwork to delivery to your dealership.

3. Obtain the COC

If the car you’ve bought doesn’t come with the certificate of conformity, you’ll have to buy one to continue with the import.

4. Pay taxes and fees

If you have to pay customs duties and VAT, now is the time to do so.

5. Apply for verification of origin

If you’ve bought vehicles to resell, these are all the steps you need to take. But before a car can be registered, its owner has to complete several steps before they can register and drive it legally.

Before registering the vehicle in Sweden, the owner must apply for verification of origin with the Swedish Transport Agency (Transportstyrelsen). This step confirms the vehicle’s identity and history.

You can apply electronically using this link, or you could send the documents by post.

Either way, the owner pays a fee of 1,240 SEK.

Get Swedish plates and traffic insurance

Once the car is registered and the taxes are paid, the owner will receive Swedish license plates by post. They’ll also have to settle the Swedish traffic insurance before the vehicle is legally allowed on the road.

Get to know the Swedish used car market

In 2024, the Swedish car market slowed down in terms of new car sales, which dropped down 9% compared to the year before.

New EVs also saw a decline, mainly because the government removed subsidies for EVs back in 2022.

Even the best-selling car, the Tesla Model Y, sold less than before. On the other hand, Volvo’s models like the XC60 and the new EX30 became more popular and helped Volvo stay on top.

Fortunately, the used car market has recently been looking differently.

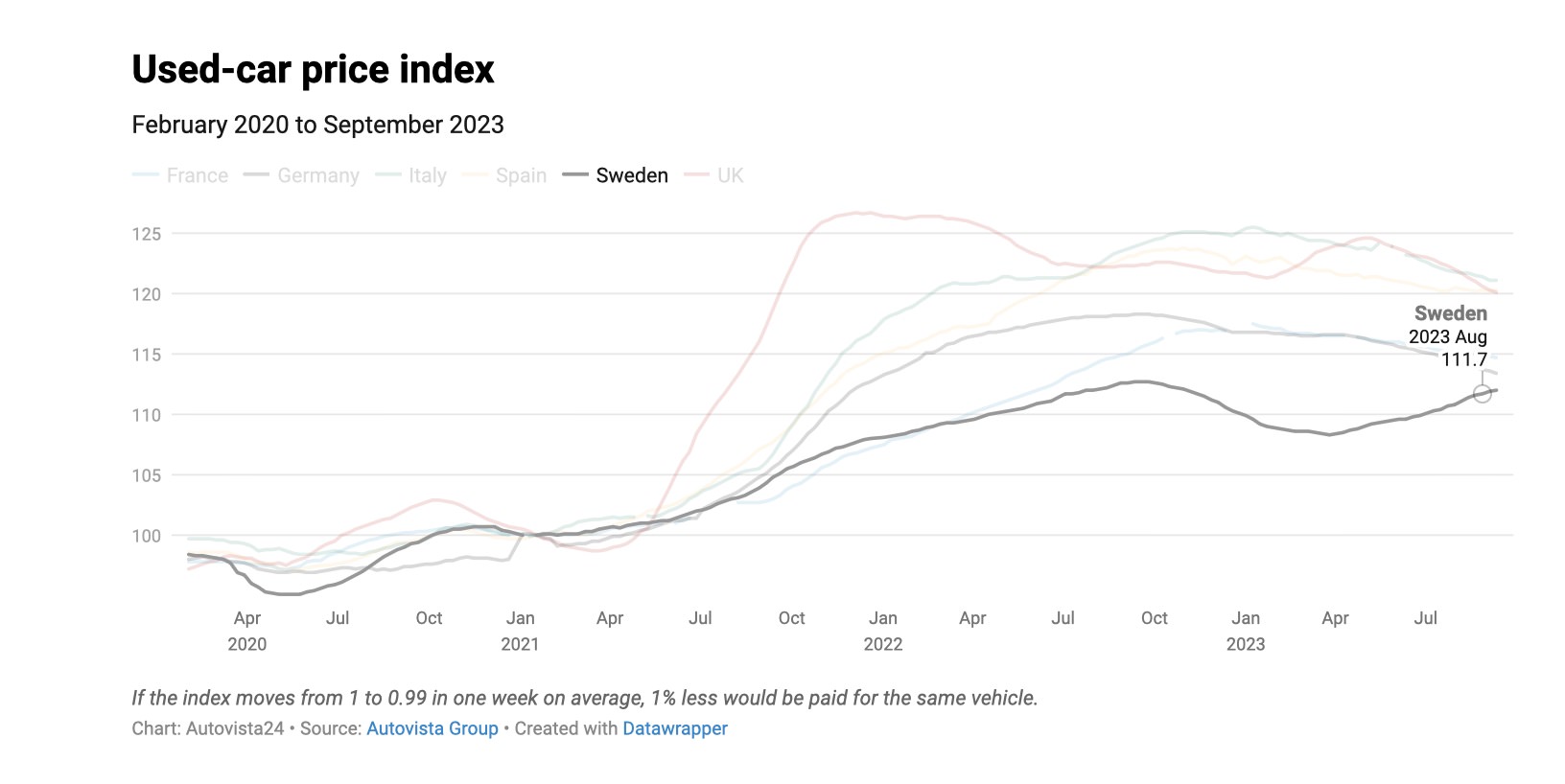

While used car prices in most of Europe went down, prices in Sweden stayed steady or even increased.

Image source: Autovista24

Buyers were less interested in used EVs and more focused on regular petrol and diesel cars, which kept their value well. Because there aren’t enough used cars to meet demand, prices have stayed high, and this situation is likely to continue.

In short, Sweden’s new car market is shrinking, and EV sales are slowing, but the used car market is strong thanks to low supply and steady demand for traditional vehicles.

Now, as a used car trader, you might want to keep an eye on today’s top new models as these could be the cars your buyers will be asking for in the next couple of years. Cars that are popular new tend to hold their value and stay attractive once they hit the second-hand market.

Some of the top models to watch include:

- Volvo XC60

- Volvo EX30

- Volvo XC40

- Tesla Model Y

- Toyota RAV4

- Volkswagen ID.4

Importing a car to Sweden - FAQ

► Do I need to pay VAT when importing a used car from the EU?

Not usually, but a lot of cars on online auction platforms are sold VAT-excluded, which means you will have to declare and pay the VAT in the country you're importing to, in this case Sweden.

► What if the car doesn’t come with a Certificate of Conformity?

You’ll need to buy one before registering the vehicle. Most used cars don’t include it by default, but you can order a replacement from authorized providers using the car’s VIN.

► What if I’m importing from outside the EU?

In that case, you’ll need to pay customs duty (usually 10%) and Swedish VAT (25%) on the full value of the car, in addition to the regular registration steps.

► Can I import multiple vehicles at once as a business?

Yes, importing in bulk is common for registered dealers. You’ll need to handle documentation and origin verification for each vehicle individually, but the process is the same.

L'importation de véhicules depuis l'Europe peut être complexe, mais eCarsTrade est là pour simplifier le processus. Découvrez comment :