- Blog

- How to Import a Car to Greece

How to Import a Car to Greece?

Learn all about importing a car to Greece, including necessary documents, tax details, registration steps, and transport options to make the process efficient.

You’ve been wanting to import cars to Greece but weren’t sure what steps you exactly need to take?

This guide is here to help you learn all about the necessary documents, taxes, and steps involved in the process. So, let’s see how you can expand your used car dealership by importing cars from the EU.

About this article

Get to know the Greek car market

Just like in most European countries, 2024 was a successful year in the Greek automotive industry. While there weren’t dramatic surges, ACEA’s Greek representative reports that there was a 1.7% increase in new car registrations compared to 2023.

This steady growth shows that the market is stable. With consistent demand and no major downturns, Greek dealers have solid reasons to source used cars from the EU.

In terms of fuel types, hybrid vehicles were the most popular choice as of October 2024. The composition of new registration by fuel type was as follows:

- Hybrid cars: 47.4%

- Petrol cars: 26.9%

- Electric cars: 9.5%

- Plug-in hybrid cars: 7.8%

- Diesel cars: 4.1%

Hybrids were leaders in new registrations, but petrol and diesel vehicles remained popular in the used car market due to their lower prices and wider availability. So, you should consider local customer preferences before deciding on the vehicle type to buy and resell.

When it comes to specific brands, popular automakers like Toyota, Peugeot, Opel and Hyundai have consistently been performing well.

Documentation for importing a vehicle to Greece as a business

To make the import process quick and efficient, you should prepare crucial documents in advance and keep them handy. Here’s an overview of what you’ll need.

Vehicle purchase invoice

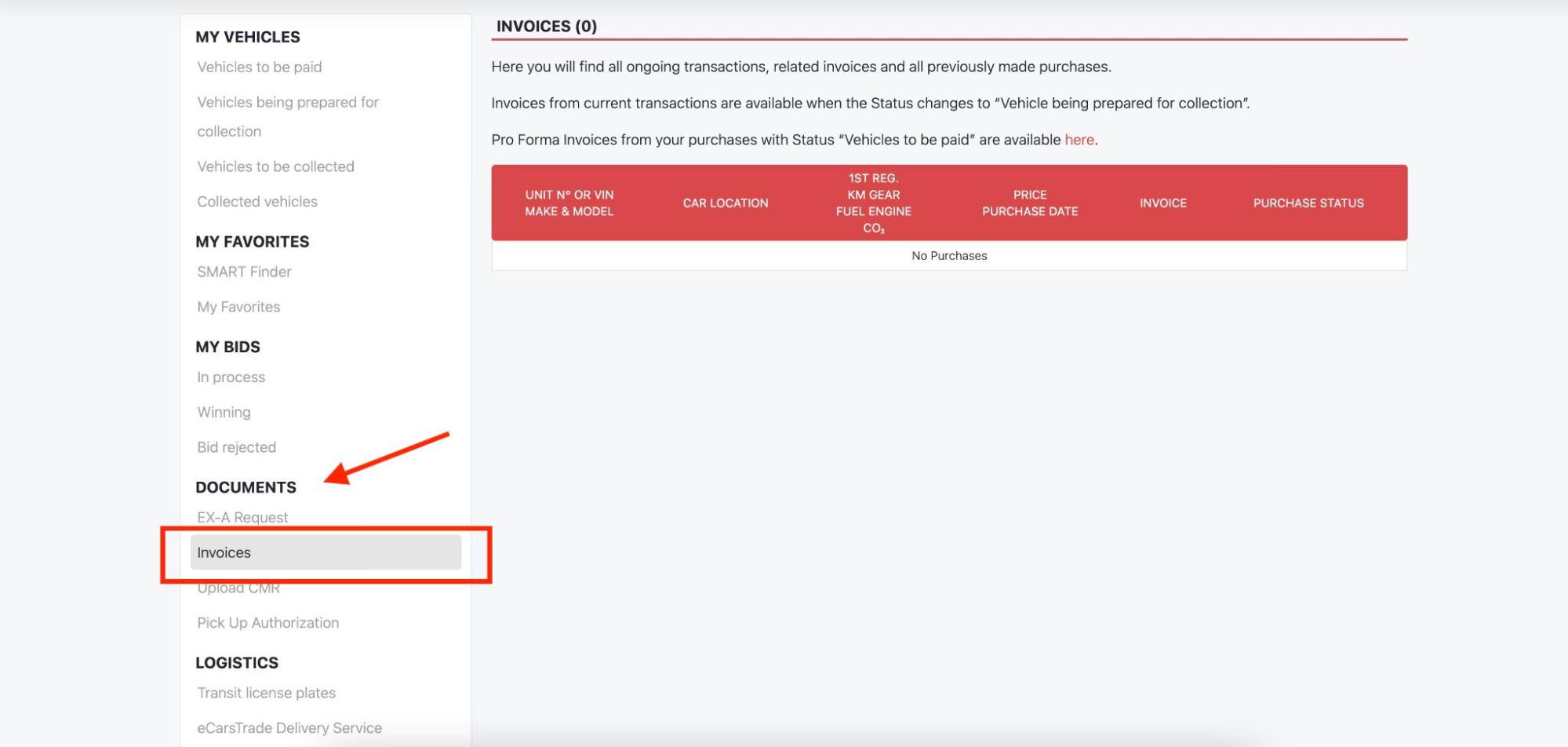

First, you’ll need to provide ownership and transaction details, which can be found on your vehicle purchase invoice. If you’ve bought the car through eCarsTrade, you can find your invoice on your Personal page on the eCarsTrade platform.

Regardless of where you’ve bought the car from, the invoice will contain details about the seller and buyer, the vehicle, the purchase price and payment terms.

Original registration certificate

When importing a car from abroad into Greece, you’ll also need the car’s original registration certificate.

The details covered in the certificate vary from country to country, but it generally includes the vehicle’s make, model, VIN, first registration date, and previous owner information.

Certificate of Conformity (CoC)

Next, you’ll need to bring the vehicle’s certificate of conformity. The certificate proves that the car meets EU safety, emissions, and technical standards.

The car’s CoC is usually issued by the manufacturer, and it sometimes arrives with used cars. However, used cars from many European countries don’t always come with CoC.

If that’s the case with the vehicle you’re importing, you can request a duplicate from the manufacturer or order one through services like EUROCOC, which specializes in providing official CoC documents.

Image source: EUROCOC

Services that provide certificates of conformity charge a fee that varies by make and model. Still, having a CoC is an obligatory requirement for vehicle registration, so make sure you obtain it prior to starting the registration process in Greece.

Declaration of vehicle’s arrival (DVA)

Another vital document you’ll have to prepare is the declaration of vehicle’s arrival (DVA). You’ll submit this document to the Greek Customs Authority. This step officially notifies customs of the vehicle’s entry into the country and is required for further processing.

You have to submit the DVA to the Customs Authority by the 15th day after the vehicle’s arrival.

Submitting the DVA allows customs to assess and apply import duties, VAT, and registration taxes. Once cleared, you can proceed with the car’s registration in Greece.

Taxes when importing a car to Greece

Estimating all the taxes and fees you’ll pay when importing a car to Greece helps you plan your budget, avoid unexpected costs, and set the right resale price. Here are the costs you’ll need to consider.

VAT (Value added tax)

You’ll have to pay VAT at a standard 24% if you’re importing new vehicles, or vehicles from outside of the EU. But if you’re importing EU used vehicles, there’s a chance you won’t have to pay VAT.

More precisely, used cars from the EU typically have VAT paid in the country of purchase. If the VAT wasn’t included in the purchase price, you’ll have to declare and pay it in Greece.

Registration tax

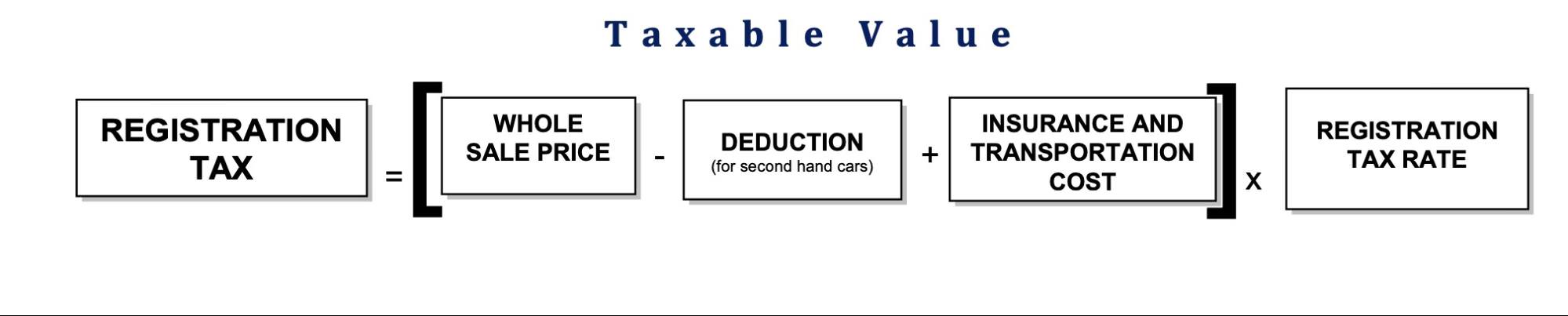

All vehicles imported to Greece must pay registration tax.

The precise amount depends on factors like purchase price, insurance cost, and transport cost. Used cars also qualify for a depreciation-based deduction, which reduces the tax based on the car’s age.

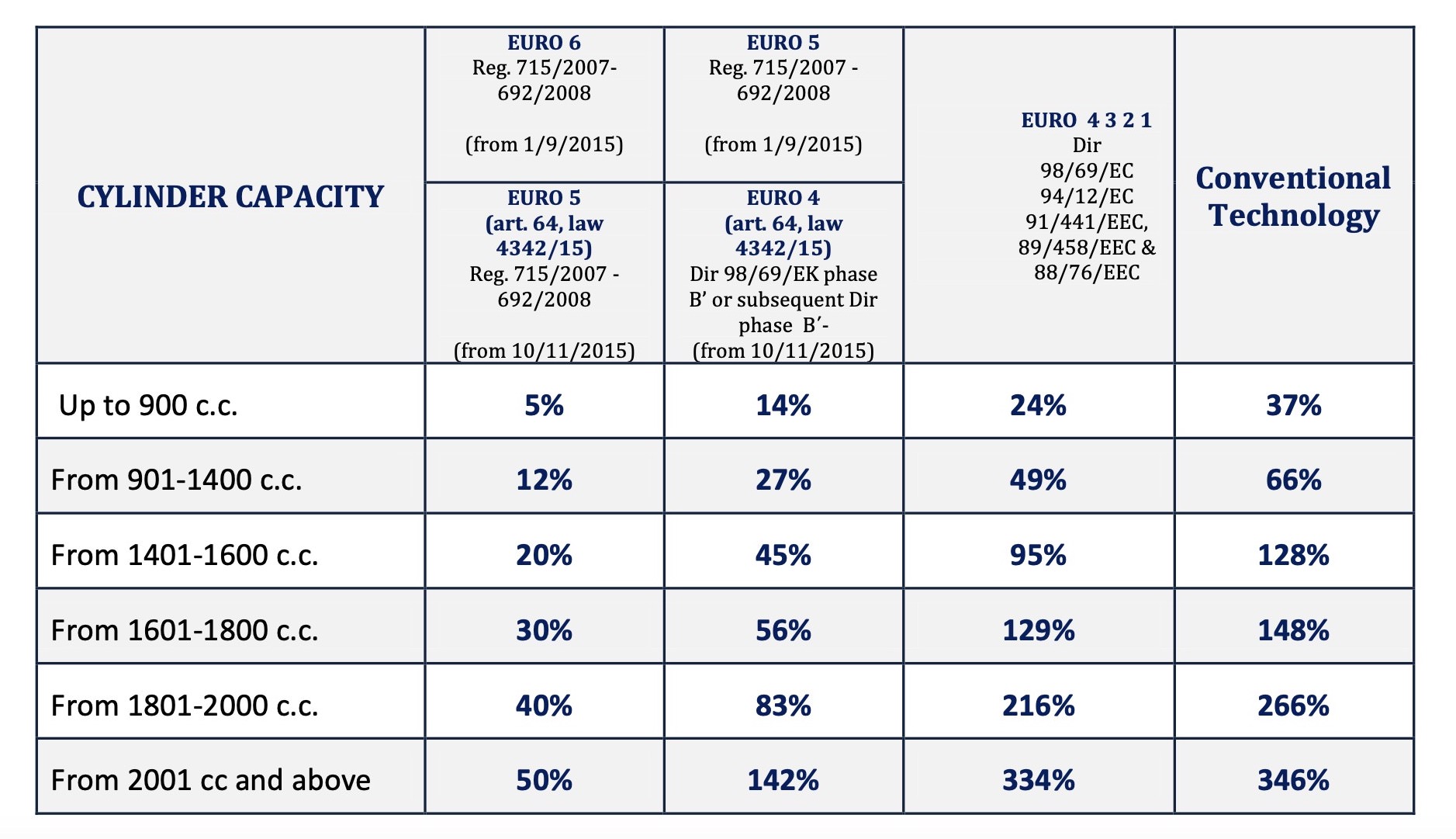

Another factor that impacts the total amount of registration tax you’ll pay is the registration tax rate.

The rate is based on engine size and emissions standard (Euro Category). Because of that, lower-emission cars are taxed lower than more polluting models, as you can see in the table below.

So, before you settle on a model to import, it’s a good idea to calculate the total tax and ensure the car remains cost-effective for resale.

Import duty

Only vehicles imported from outside the EU are subject to import duties, in addition to taxes listed above.

Step-by-step process - from purchasing a car to importing it to Greece

After you’ve seen the overview of documents and taxes you’ll encounter, let’s see the step-by-step procedure of importing cars to Greece.

Research and purchase the car

The best strategy is to start by researching the market you’re importing to. For instance, our list of top ten best sellers in 2024 can be a great starting point, and you can complement it by checking your local demand as well.

Once you’ve identified cars that would sell fast, proceed with finding a reputable supplier, such as eCarsTrade.

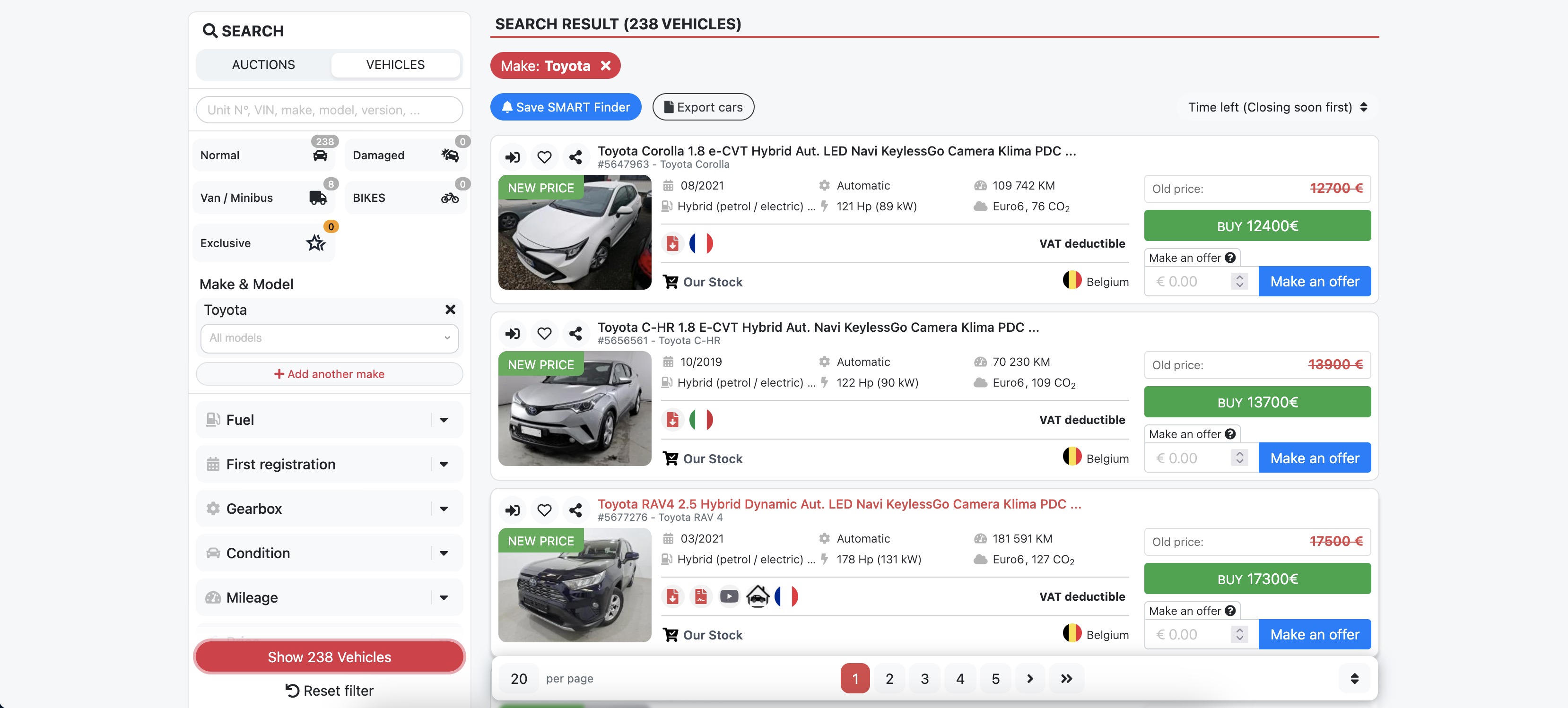

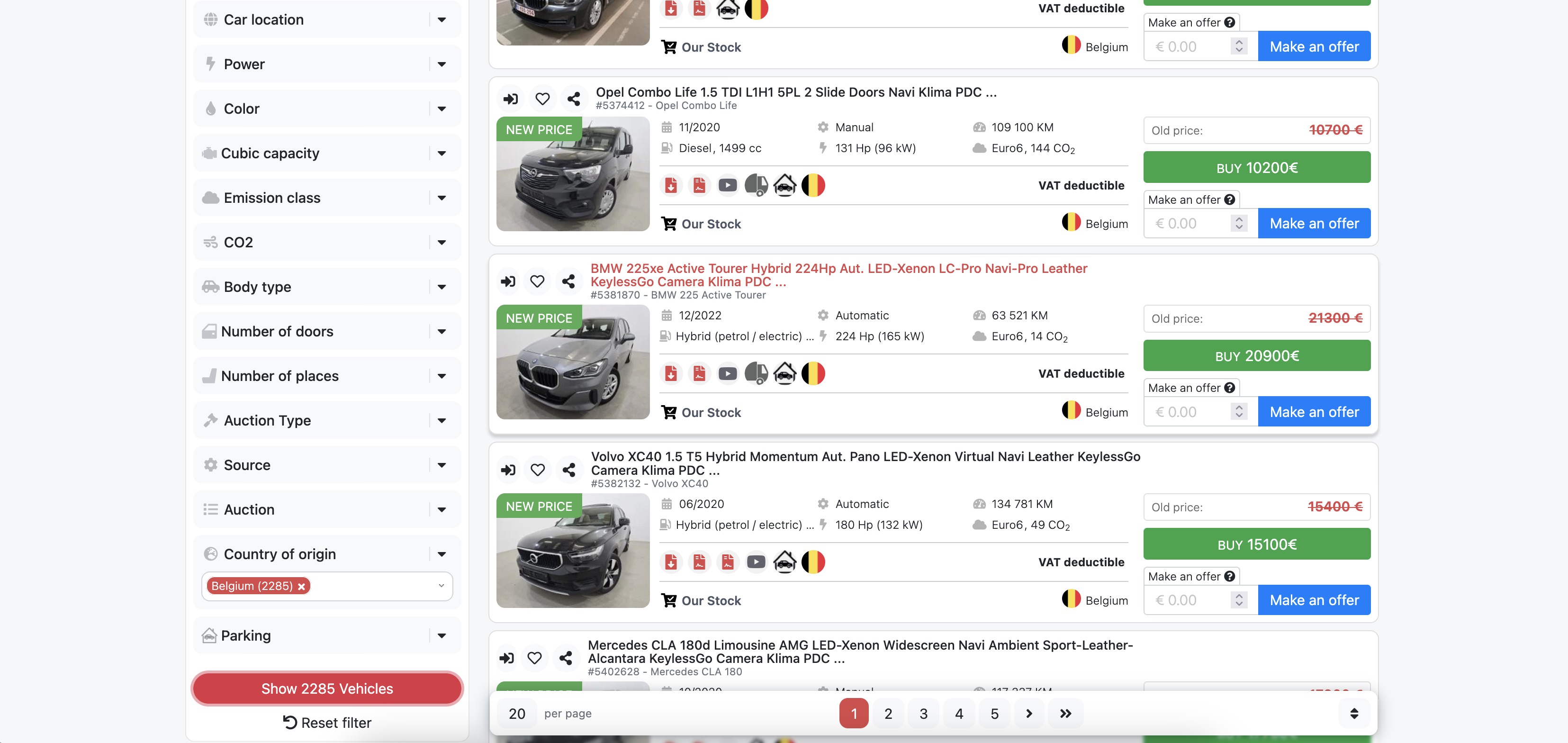

eCarsTrade is an online auction platform where you can get quality used cars from countries across Europe. You can browse by make, model, fuel type and more.

You can place bids, buy at fixed prices, or get a car from our own stock. Either way, purchasing the vehicle marks the start of the import process.

Go through technical control in the country of origin

Now, this is a vital step that’s specific to the Greek market. If you’re importing a car that’s older than 4 years into Greece, you have to take it through technical inspection in the country you’re buying from, before the car leaves the border.

So, if you were buying a used car from a seller in Germany, you’d have to do a technical inspection in Germany. As we wanted to simplify the process for our buyers, eCarsTrade only offers cars located in Belgium, right where we are, to customers from Greece. That way, we can take the cars for inspection before they’re shipped to you.

If you’re buying from eCarsTrade, you’ll find filtering by country helpful, as you can select to only browse cars located in Belgium.

In case you’re buying from other suppliers, make sure you check if they can take the car through inspection on your behalf.

Remember to keep the inspection certificate from the car’s country of origin, as you’ll need it during the registration process.

Once the car has passed the inspection in the country of origin, you don’t have to take it through the inspection in Greece again. So, this step doesn’t have to be a complication—it’s just an alternative order of import steps!

Prepare the documentation

Prepare your vehicle purchase invoice, original registration papers, and the certificate of conformity so that you have all necessary documents handy at every stage of the import process.

Arrange transportation

The most efficient way to move cars between dealerships is to hire a specialized transport company.

Letting the professionals transport cars by truck not only keeps vehicles secure, but also simplifies logistics. At eCarsTrade, we can organize delivery of your cars to Greece (islands excluded) through our eCarsTrade Delivery Service. Simply contact your Account manager for more information.

Submit the DVA

Your car has arrived! This means that it’s time to notify the Customs Authority of its arrival by submitting the Declaration of Vehicle’s Arrival.

If you drove the car yourself, you have to submit the DVA at the nearest customs office to the entry point. If you’ve had it loaded and shipped by a transport agency, the DVA must be submitted to the customs office at the first unloading location in Greece.

Pay VAT

The next step is paying the VAT. Check with your local customs office to see the exact amount due and the payment process.

Obtain insurance

Before registering the car in Greece, you must secure valid car insurance. Browse insurance providers, compare options, buy a policy, and you can proceed with registration.

Register the car

The final step is registering your imported car. To complete registration, submit the following:

- Proof of VAT payment

- Technical inspection certificate

- Declaration of Vehicle’s Arrival (DVA)

- Vehicle purchase invoice

- Original registration certificate

- Certificate of Conformity (CoC)

- Proof of insurance

At this stage, you’ll have to pay the Registration tax. Once you’ve done this step, your car is ready for resale.

Importing a car to Greece - FAQ

► How is the registration tax calculated for imported cars?

The registration tax depends on the car’s engine size and emissions rating (Euro standard). Cars with smaller engines and lower emissions pay less, while older, higher-emission models are taxed more. There’s also a deduction for used cars.

► Where is the technical control carried out?

Used cars that are newer than 4 years go through technical control in Greece. However, if you’re importing cars that are older than four years, you’ll first have to take them to the inspection in their country of origin.

► The car I chose doesn’t have a CoC, what now?

If your car doesn’t have the original certificate of conformity, you can purchase one online. You can request that they ship the CoC to your location instead of it being delivered with the car.

L'importation de véhicules depuis l'Europe peut être complexe, mais eCarsTrade est là pour simplifier le processus. Découvrez comment :