- Blog

- Are Used Cars Getting More Expensive in Europe in 2025?

Are Used Cars Getting More Expensive in Europe in 2025?

Get clear insights into 2025 used car market trends, including price changes, regional demand, and performance by fuel types.

Whether you’re selling used cars to businesses, fleets, or private buyers, used car prices affect your margins, your sourcing strategy, and even how fast the cars sell.

So, with market conditions changing across the EU, it’s becoming more important to track car prices, and also check how supply and demand are behaving.

That’s why we’ll look back at the trends from 2023 and 2024, and then focus on what’s been going on in early 2025. You’ll then be able to adjust your sourcing and pricing more effectively.

Quick recap: Used cars sales trends in 2023/24

Used car market across most of the EU stayed relatively strong through most of 2023 and into early 2024.

In fact, 2024 ended very well, especially when you compare it to new car registrations, which declined in several key countries, according to data from Autovista.

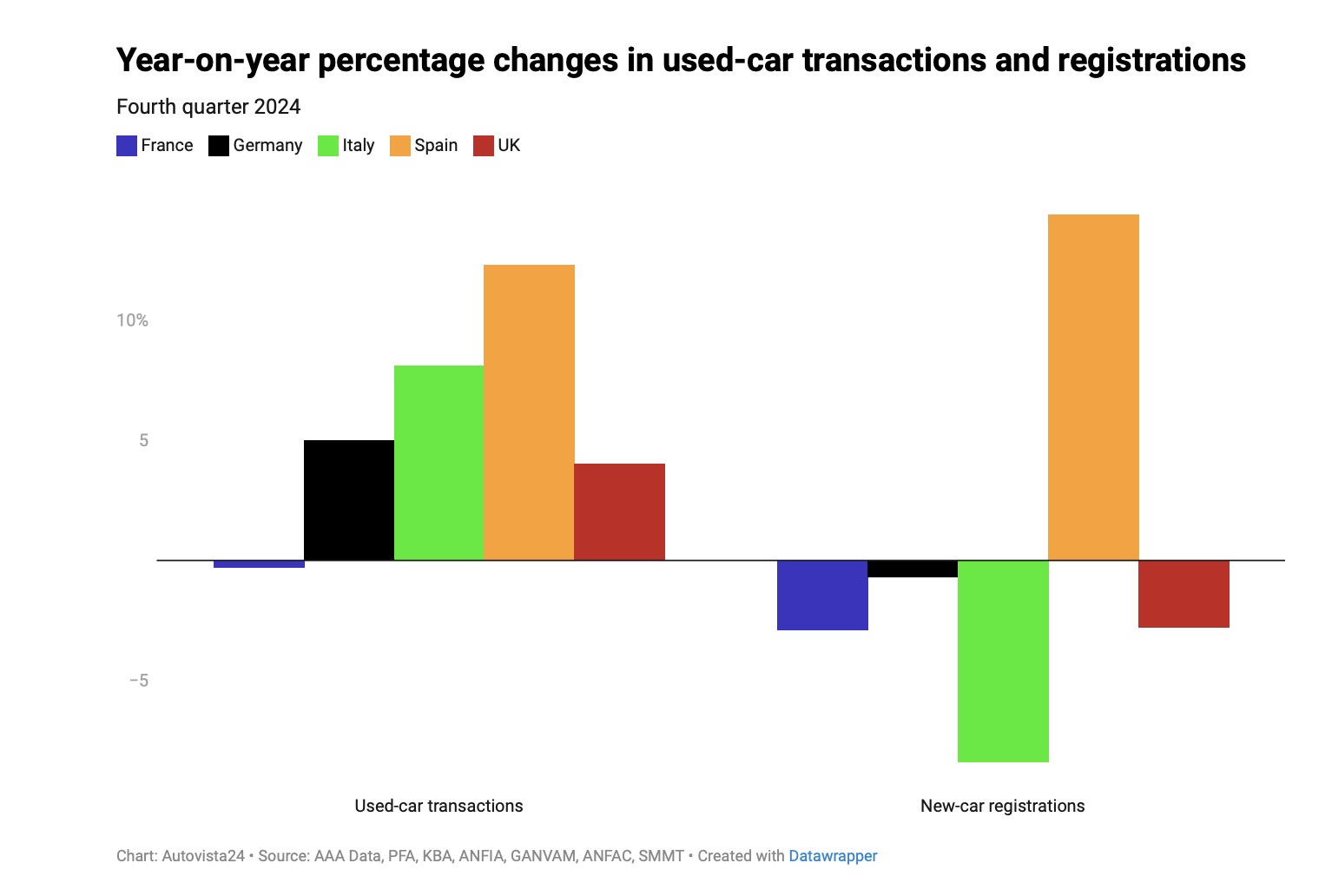

Image source: Autovista24

In the fourth quarter of 2024, used car transactions increased in countries like Spain (+11%), Italy (+8%), and Germany (+5%), while new car registrations fell in places like Italy (-7%) and France (-4%).

This shows us how active the used market remained, even as the demand for new cars weakened.

But when it comes to car prices and values, Autovista’s December 2024 report shows that residual values declined across most major EU markets.

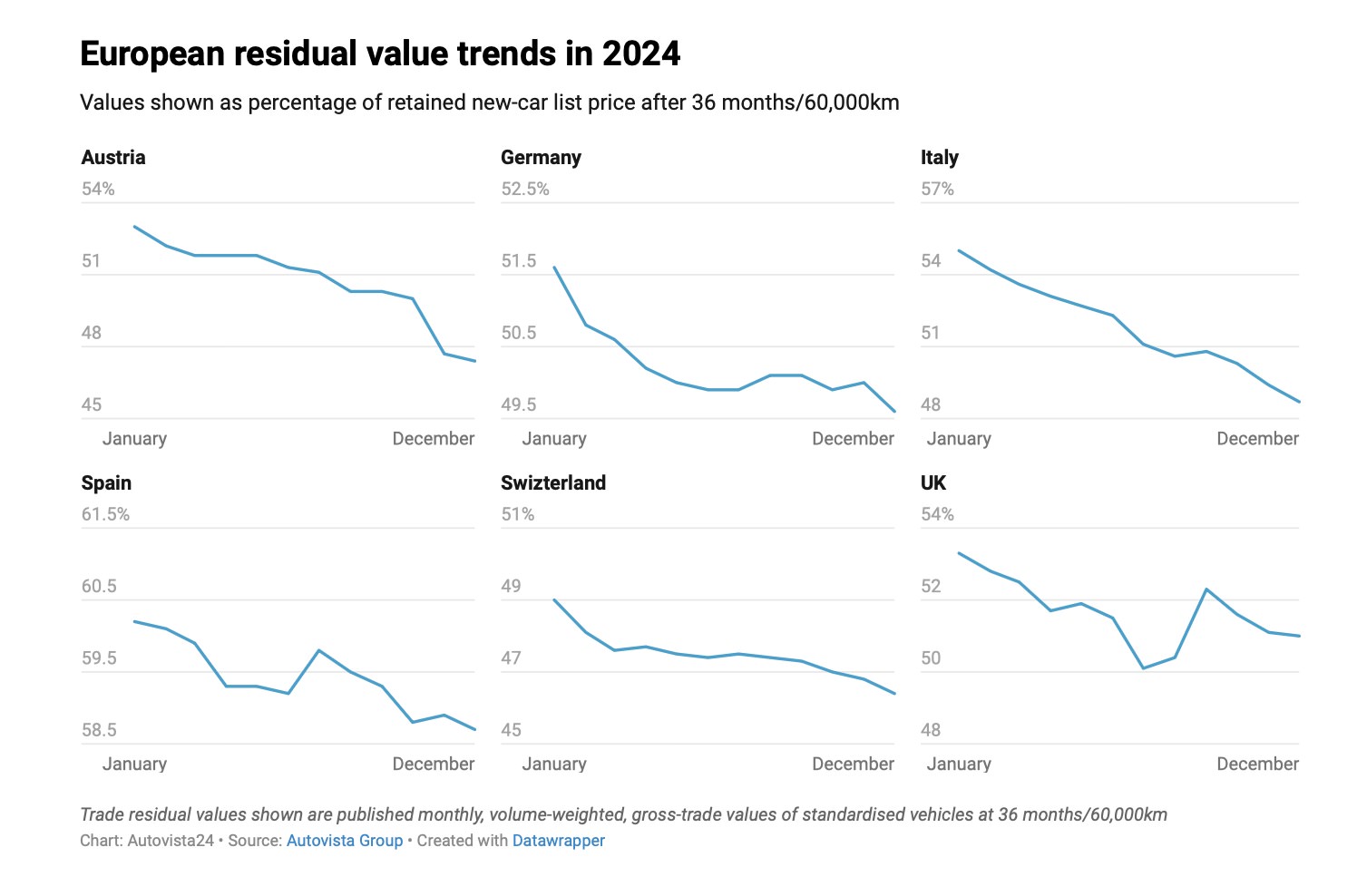

Image source: Autovista24

Residual value is the estimated market price of a car after three years and 60,000 kilometers.

It’s often used to track how car values hold up over time. When residual values fall, it often signals that used car prices are starting to come down.

So, while the number of cars sold remained high, there were early signs that prices had started to fall by the end of 2024.

Reality of used car prices in the EU in 2025

We’re now well into 2025, with the first half of the year behind us.

So, how has the used car market actually performed so far?

In terms of used car sales, activity stayed strong in several key markets, states Autovista.

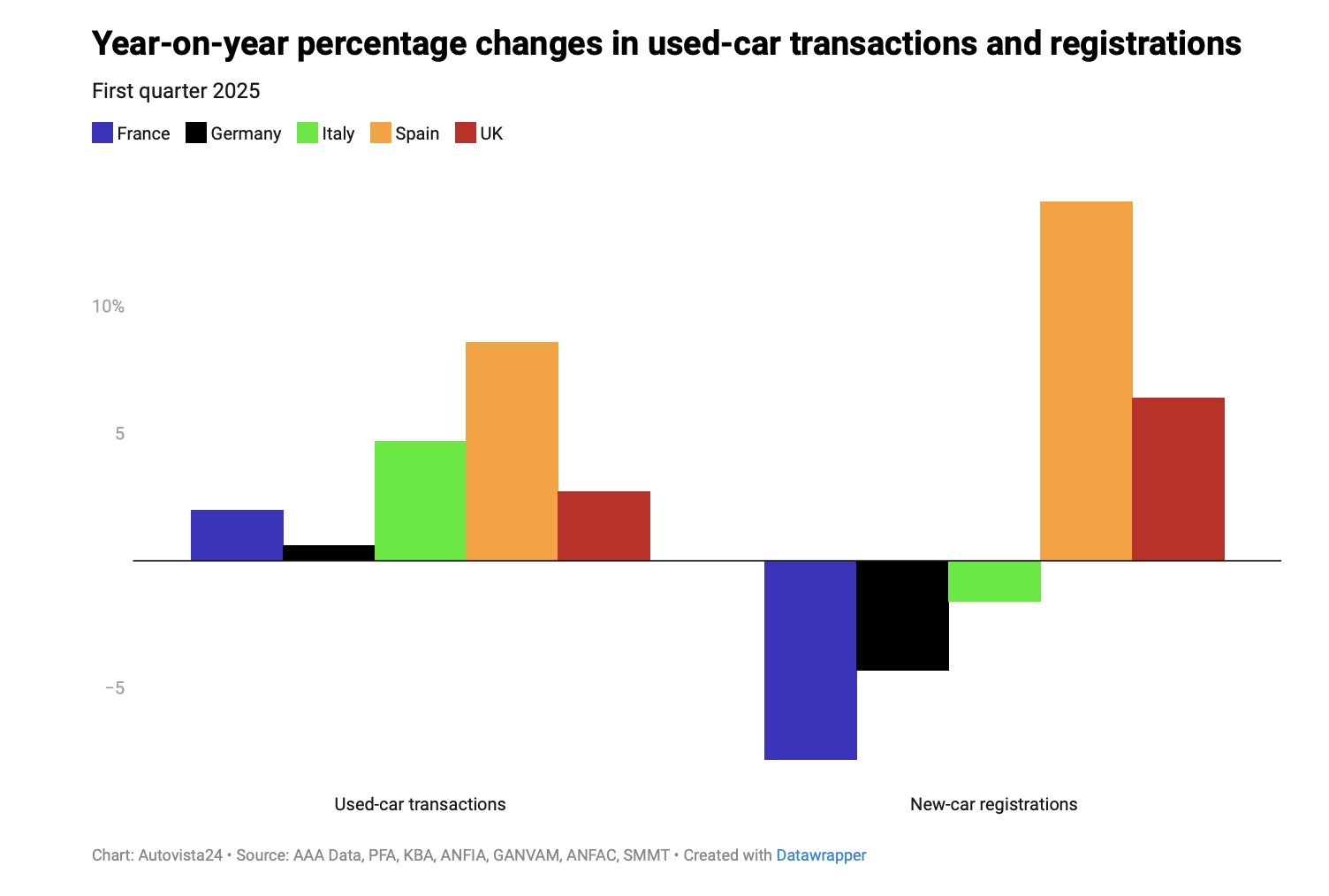

In Q1 2025, used car sales increased in Spain (+9%), Italy (+4.6%), and France (+2.5%), while Germany remained stable compared to the year before.

Image source: Autovista24

The continued growth of used car transactions shows that buyers are still choosing used cars over new ones.

Meanwhile, new car registrations are still going down in some markets. France and Germany had a fall in new car registrations by around 7% and 5% respectively, continuing the trend from late 2024.

Changes in price, demand and supply in 2025

On the pricing side, wholesale values (those prices that dealers pay when sourcing vehicles from auctions or suppliers) continued to fall.

According to the AUTO1 Group Price Index for March 2025, used car prices fell 4.8% compared to the same month last year.

But on the retail side, where dealers set prices for end customers, prices have remained more stable. As Fleet Europe reports, many dealers are reluctant to lower prices too quickly, especially on newer stock.

Some traders are keeping the old prices to protect their profits, while others are adjusting strategically based on their local demand, model, and fuel types.

Overall, demand is still there, but traders are seeing smaller profits, so they need to watch prices more closely.

The difference between what you pay for a car and what you can sell it for is getting smaller, so focus on stock that turns quickly and avoid overpaying for slower-moving models.

Regional trend and price variations across EU markets

Knowing how the market looks in general is always helpful, but traders make their decisions locally. So, let’s take a closer look at how prices and trends vary across EU countries.

We’ll use data provided in Autovista’s Monthly market dashboards.

► France

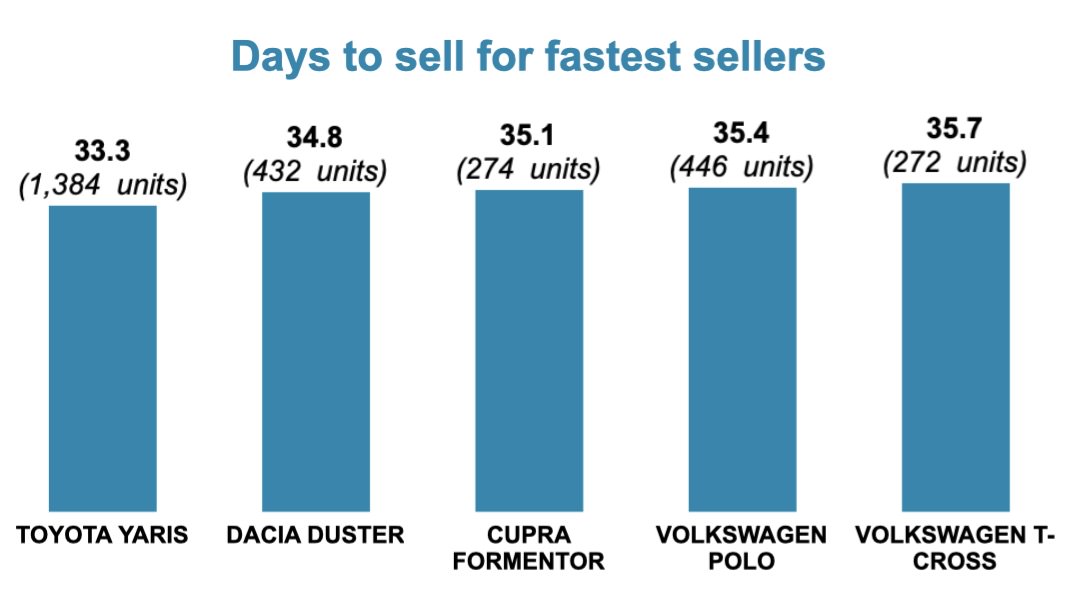

In France, the used car market has slowed down in the first half of 2025. Fewer cars are being sold, and they’re taking longer to sell, with an average of almost 60 days before a car changes hands.

Fortunately, some fast-selling models are still moving quickly, so there’s no need to be discouraged.

Autovista data shows that while list prices have gone up, trade values have dropped. In other words, French dealers are often paying more for stock but seeing less value when reselling.

A few models like the Toyota Yaris and Dacia Duster are still selling quickly, but overall, the market is slower and less profitable than it was in 2024.

When it comes to electric vehicles, the slowdown is even more pronounced.

EVs now take almost 80 days to sell on average, which is significantly longer than petrol or diesel models. So, if you're running a dealership in France, it's worth being more selective with electric cars.

At the same time, higher taxes on internal combustion engines are starting to shift buyer interest slowly toward electrified models.

Sales might not be fast just yet, but government policy is moving in that direction, which could affect demand in the months ahead.

► Spain

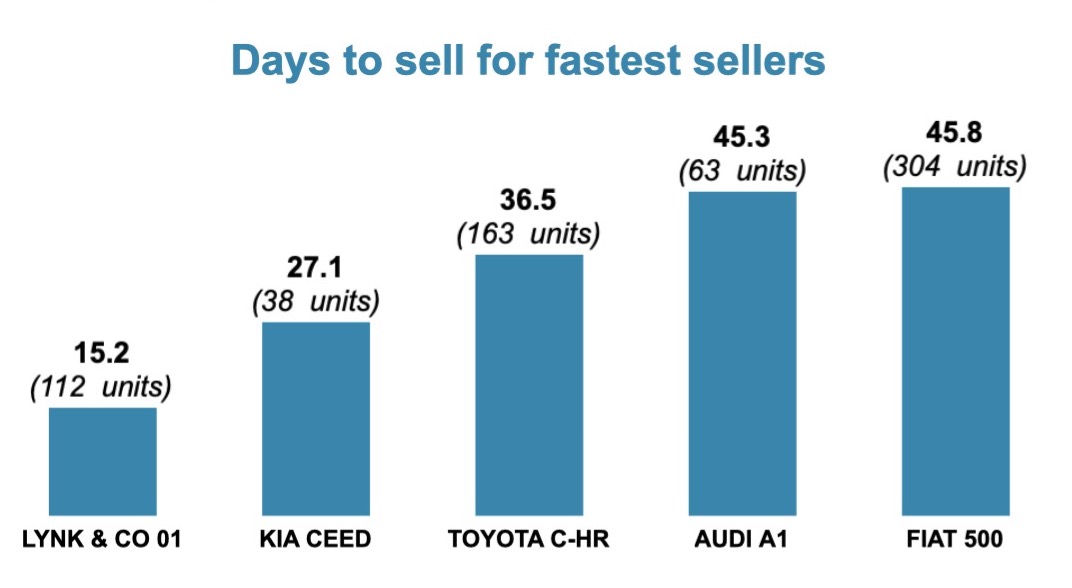

The used car market has remained active so far in 2025, although there are some signs of pressure.

Cars are selling more slowly than before, with an average of 67.3 days to sell across all fuel types. That’s still faster than last year, but the momentum has clearly slowed.

The number of used car sales has dropped. While advertised prices have slightly increased, dealers are actually selling cars for less than before, which makes it harder to maintain solid margins.

Some models are still turning quickly, such as the Lynk & Co 01, Kia Ceed, and Toyota C-HR, giving traders solid opportunities for faster sales.

Looking specifically at electric vehicles, things are more difficult. EVs in Spain now take over 92 days to sell on average, so the overall EV segment is moving slowly and seeing weaker demand.

► Germany

It takes around 58 days to sell a used vehicle in Germany in 2025. That’s an encouraging figure, as it’s almost 10 days faster than a year ago.

Still, there are fewer transactions and there’s a drop in the sales volume index, but demand for the right models remains healthy.

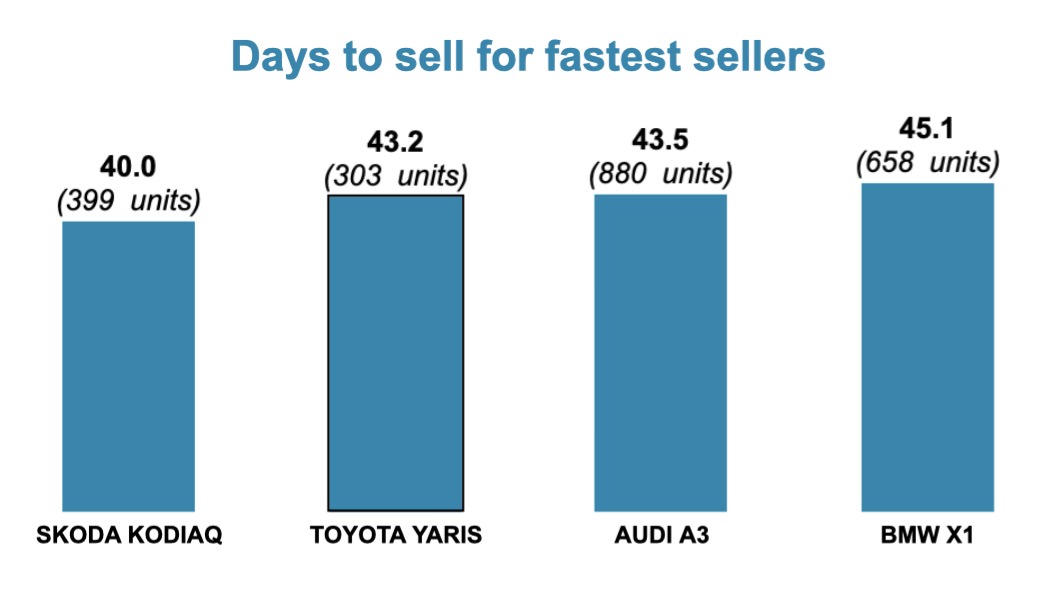

So, if you were to stock used Skoda Kodiaq, Toyota Yaris, and Audi A3, you’d likely be able to sell these models in 40 days.

Compared to traditionally-fueled cars, the electric segment is holding up well. EVs take about 58 days to sell, which is the same as the average of all fuel types combined.

Popular models like the BMW i3 and Tesla Model 3 are turning over even faster, often in under 30 days. Volumes are down, but well-priced EVs can still perform strongly.

► Italy

Used car sales have been relatively stable in the first half of 2025, although selling times have slightly increased.

It now takes just under 55 days to sell a used car in Italy, which is still faster than in many other EU markets.

List prices remain steady, but the prices dealers get when reselling have gone down compared to last year, meaning that profits may be harder to achieve.

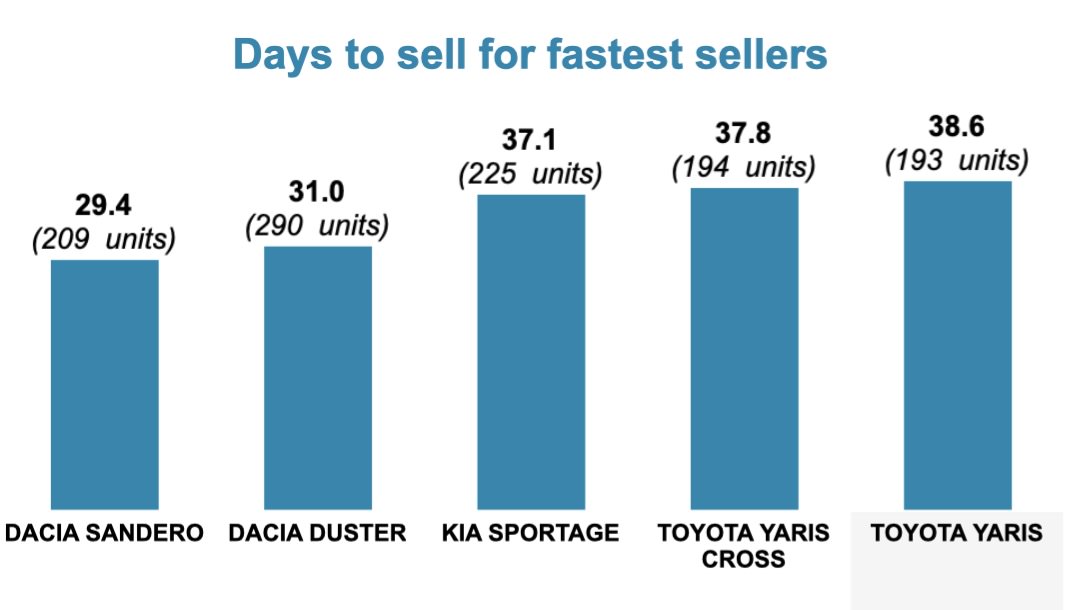

Popular models like the Dacia Sandero, Dacia Duster, and Kia Sportage, are still moving quickly, often in 30 to 37 days.

EVs are facing a tougher market, although EVs like the Kia EV6 and Dacia Spring are showing good performance. So, while EV demand in Italy isn’t booming, there’s still room for smart, selective selling.

► Poland

Poland’s used car market has had a tough start to 2025, as there’s been more supply than demand, so many cars are sitting on the market for longer than expected.

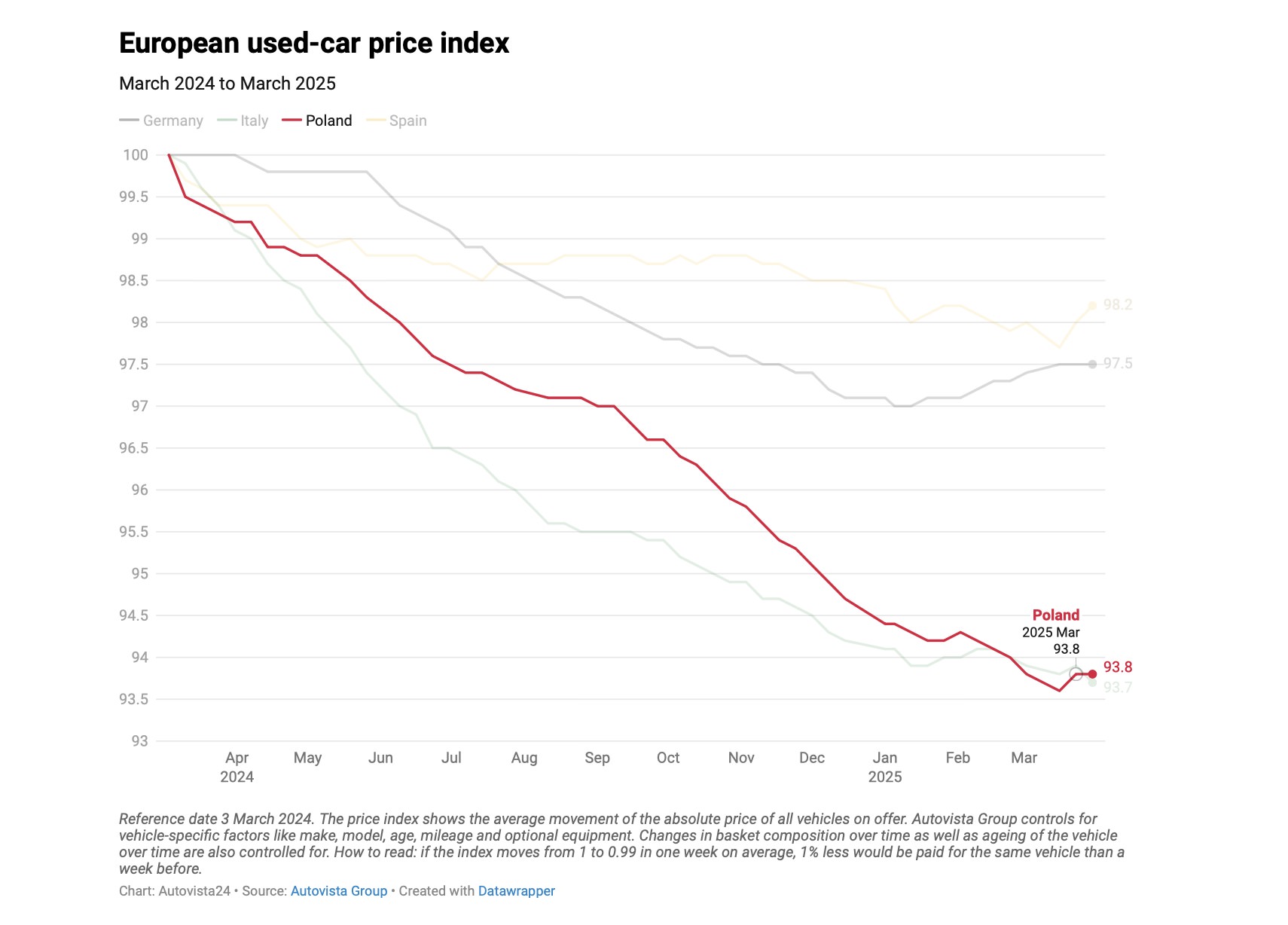

One of the biggest challenges is falling prices. According to Autovista, Poland’s used car price index dropped to 93.8 by March 2025, which is the steepest decline among other big EU markets.

Image source: Autovista24

While price drops can sometimes help boost demand, that hasn’t been the case here.

Buyer interest is still low, and dealers are struggling to maintain profitability. Note that light-commercial vehicles are having an even harder time than passenger cars in Poland.

So, now is not the time to take big risks or overstock on slower models. It’s better to stick to safe bets, which are the cars you know will turn quickly and hold value even in a weaker market.

► Croatia

Croatia’s new car market saw a slight dip at the beginning of 2025. According to SeeNews, reporting the data from ACEA, new car registrations in Croatia fell by 1.9% in the first quarter compared to the same period last year.

While this figure reflects the new car segment, it still suggests that people might hesitate to buy cars in general, which can affect the used car market too.

► Romania

Romania’s car market has slowed down in 2025. According to Focus2Move, new vehicle registrations fell by 6.1% from January to April compared to the same period last year.

The top-performing brands have remained familiar in Romania, with Dacia, Toyota, and Hyundai leading the way.

Still, even though Dacia continues to lead the market, its registrations dropped by around 10% compared to the same period last year.

Because of that, and the fact that the Romanian EV market has seen the sharpest drop in demand so far, car traders should expect customers to turn to affordable, petrol-powered models from trusted brands.

► The Netherlands

Focus2Move states that the Dutch car market has slowed down in 2025.

New vehicle registrations fell by 6.2% in the first five months of the year, following strong growth in 2023 and 2024.

Interestingly, the EV segment continues to grow in the Netherlands, with registrations up 3.4% so far this year (and a market share reaching 23.2%), so that could be your signal to start preparing for more interest in used electric cars.

When it comes to brands and fuel types, Kia is now leading in both total sales and EV registrations, with strong growth this year.

BMW is seeing more interest in its electric models, while Toyota and Hyundai have seen their numbers go down.

Are used cars getting more expensive? ICE vs EV vs Hybrid vs LCV price dynamics

As you’ve seen, most regional markets have seen differences in how fuel types perform in sales. These differences are visible in pricing, too.

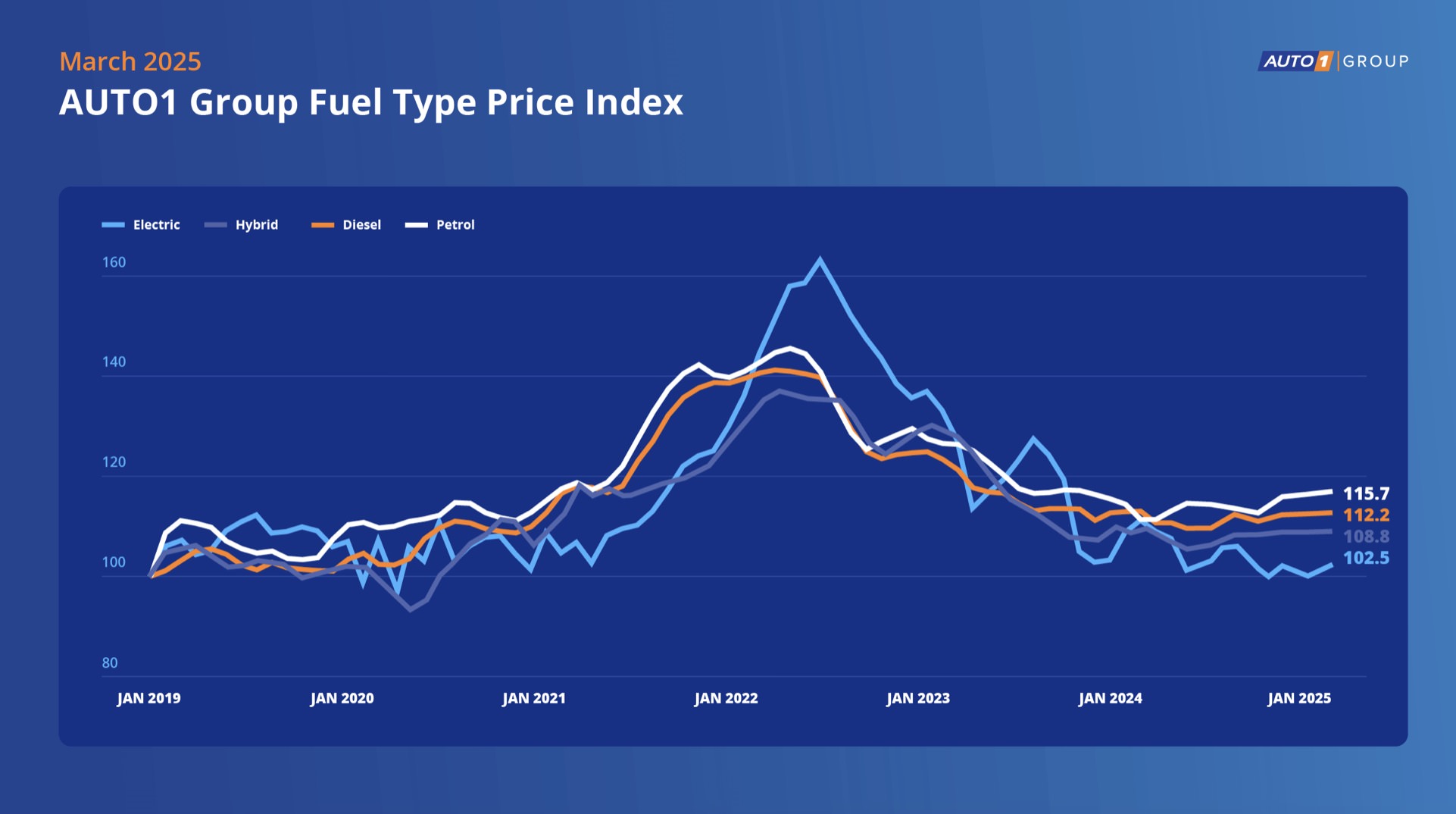

According to the AUTO1 Group’s March 2025 data, used hybrid cars are now the most expensive on average, followed by petrol and diesel.

That’s a big change compared to two years ago, when electric cars had the highest price index.

Image source: AUTO1 Group

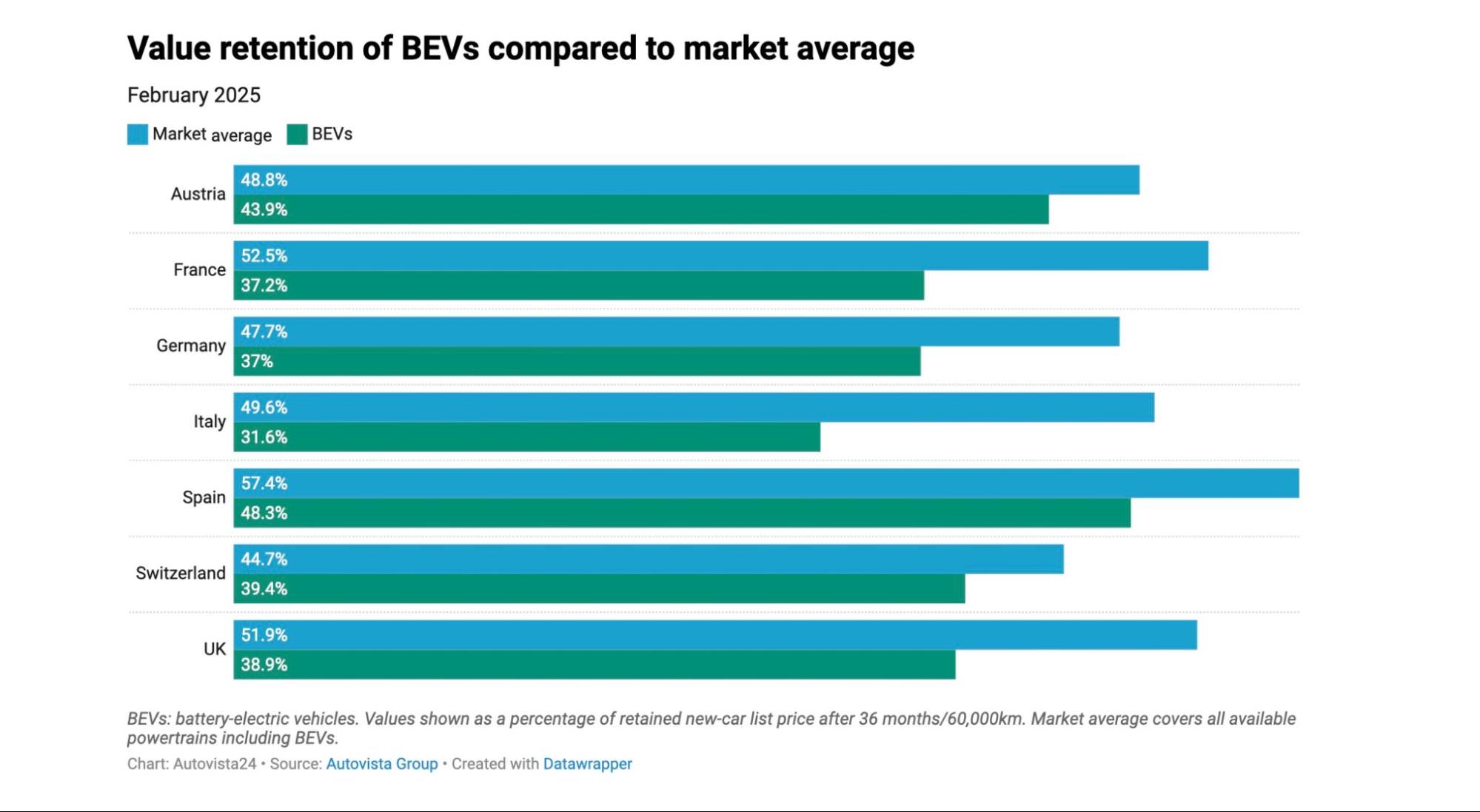

Price isn’t the only factor to watch, though. How well a car holds its value also matters.

Recent data shows that BEVs retain less value than other vehicles. In countries like France, Germany, and Italy, electric models are worth 10 to 18% less than the market average after three years.

Image source: Autovista

However, that shouldn’t deter you from stocking EVs if your local market is responding well to them.

Most buyers are aware that EVs lose value faster (Here’s how and why!), but for many, that simply means they can now get an electric car at a much lower price than before.

How to stay one step ahead with eCarsTrade?

Like always, you should approach supplying your dealership strategically, starting with buying the right stock, and that’s something that eCarsTrade can help you with.

Our online auction platform gives you access to thousands of used vehicles across Europe, so that you can find models that fit your market and your budget.

Once you’ve identified the models you’re interested in, you can check the auctions on eCarsTrade, where each listing includes clear vehicle details, photos, and transparent pricing, so there are no surprises.

With such an effective way of stocking your dealership, you can stay competitive no matter how the market shifts.

Expert predictions for 2025-2026

As we move into the second half of 2025 and look ahead to 2026, industry experts expect used car prices to stabilize or decline gently, rather than seeing sharp spikes.

Autovista Group expects used car values to drop slightly in 2025, by about 2.5% on average across Europe.

The biggest price drops are likely in Belgium, while markets like the Netherlands are only expected to see a small dip.

The outlook for 2026 is fairly stable, with countries like Sweden, Finland, and the Netherlands predicted to see a bit of growth again. Also, a small drop (1%) in used-car values is expected again in 2027.

By paying attention to these predictions in advance, you still have time to adapt your strategy, improve your stock, and stay competitive.

Are used cars getting more expensive - FAQ

Here’s a quick overview of the most common questions dealers ask about used car prices in 2025.

► Are used cars more expensive in Europe?

Prices are still higher than before Covid, but they’ve started to ease in 2025, and they vary by region and car type.

► How much have used car prices increased in the EU since COVID?

Between 2020 and 2023, prices rose sharply, almost by 30% in some markets. But since 2024, values have started to come down in many countries.

► Are used car prices expected to fall in 2025?

Yes, slightly. Most reports expect a gradual softening in prices, especially for slower-selling models and EVs.

► What types of used cars are most profitable to stock in 2025?

Hybrids, compact petrol cars, and fast-selling SUVs are performing well.

► Are electric cars getting cheaper on the used market?

Yes. Prices have dropped compared to 2022, and many used EVs now cost less than hybrids.

► Should dealers stock more EVs or ICE vehicles in 2025?

That depends on your market. In countries with EV incentives, stocking more EVs makes sense. In most other markets, traditionally fueled cars still sell faster.

Notre vaste inventaire comprend différentes marques et différents modèles pour répondre à tous vos besoins, provenant directement de sociétés de leasing, de sociétés de location à court terme et de concessionnaires européens réputés :

_01JE9WH8CRTMG3B3WDH56WNJHD.png)